Is Scotiabank Still a Bargain After 35.6% One Year Share Price Jump?

Reviewed by Bailey Pemberton

- Ever wondered if Bank of Nova Scotia is trading at a fair price today? You're not alone; many investors are asking whether the current share price offers true value or signals caution ahead.

- The stock has climbed 1.9% over the past week and an impressive 18.9% year-to-date, building on a one-year surge of 35.6%. This points to shifting market sentiment and perhaps stronger growth potential than before.

- Recent headlines have highlighted the Canadian banking sector's resilience amid macroeconomic shifts, including strong capital positions and cautious optimism around loan growth. This has contributed to renewed interest in large banks like Bank of Nova Scotia and helped support the latest move in the share price.

- Despite these gains, Bank of Nova Scotia earns a valuation score of 1 out of 6 on our in-depth checks, suggesting undervaluation in just one area. In the next section, we'll break down what this means across popular valuation approaches and reveal a smarter framework for putting these numbers into context by the end of the article.

Bank of Nova Scotia scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of Nova Scotia Excess Returns Analysis

The Excess Returns valuation method examines how effectively Bank of Nova Scotia is using shareholder equity to generate profits above the required cost of capital. This approach focuses not only on the current return on invested capital, but also on analysts' outlook for future growth and stable profitability.

Based on current estimates, Bank of Nova Scotia boasts a book value of CA$67.45 per share and a stable earnings per share (EPS) of CA$7.99, as projected by a consensus of nine analysts. The cost of equity is CA$5.41 per share, which means the bank is generating excess returns of CA$2.58 per share. Essentially, that is money made beyond what investors could expect from an average investment of similar risk. The bank’s average return on equity stands at an impressive 12.42%. Furthermore, projections place its stable book value at CA$64.34 per share, underscoring consistent value creation (again, based on the average forecast from analysts).

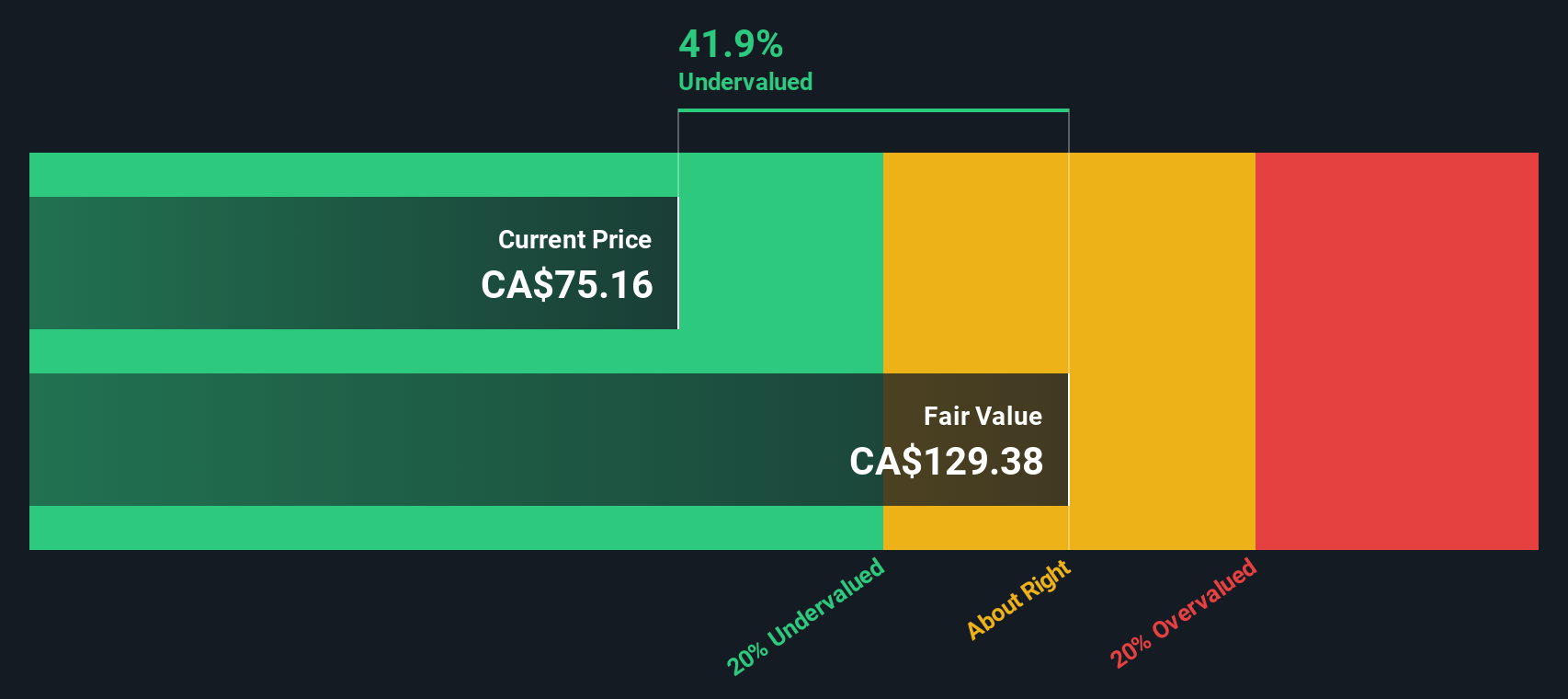

According to this model, Bank of Nova Scotia’s intrinsic value is estimated at CA$108.86 per share, which is 15.6% above its current trading price. This suggests the stock is currently undervalued in the market.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of Nova Scotia is undervalued by 15.6%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

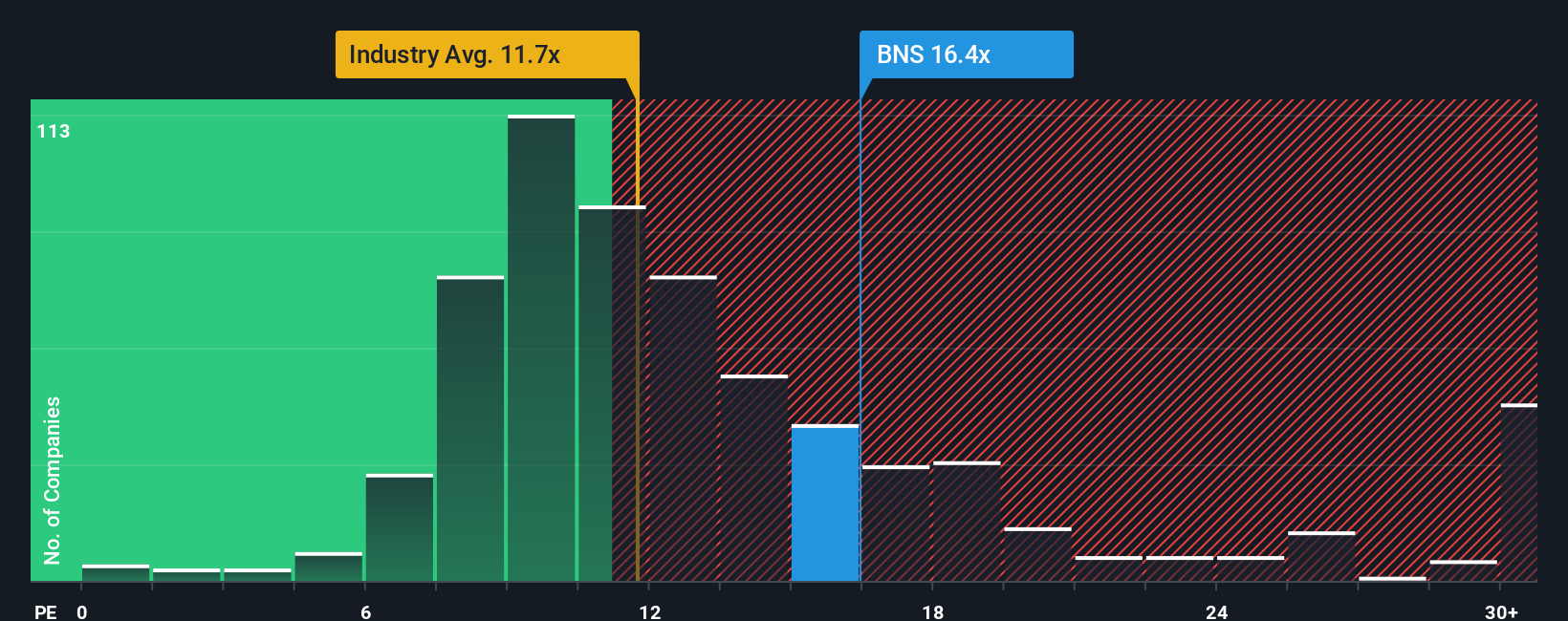

Approach 2: Bank of Nova Scotia Price vs Earnings

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like Bank of Nova Scotia because it offers a direct snapshot of how much investors are willing to pay today for a dollar of the company’s earnings. For businesses with stable and positive bottom lines, the PE ratio is a practical way to gauge whether the stock is relatively expensive or cheap versus other options.

Growth expectations and company-specific risk play pivotal roles in determining what counts as a “normal” or “fair” PE ratio. Higher anticipated earnings growth and lower risk typically justify a higher PE, while slower growth or higher risk may warrant a lower multiple.

Currently, Bank of Nova Scotia trades at a PE ratio of 17.08x. This sits above the industry average PE of 10.20x, and also above the average of its closest peers at 13.65x. That might suggest the stock is richly valued compared to the sector. However, Simply Wall St’s proprietary “Fair Ratio” for Bank of Nova Scotia is calculated at 14.97x. Unlike raw peer and industry comparisons, the Fair Ratio accounts for the company’s unique blend of earnings growth expectations, profit margins, overall risk, and even market capitalization. This results in a more nuanced, company-specific benchmark for value.

Given that Bank of Nova Scotia’s current PE ratio is only modestly above its Fair Ratio, and the difference is less than 0.10x, it suggests the shares are priced about right relative to their underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of Nova Scotia Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, accessible story that brings together your view on a company’s future, linking your assumptions about revenue, profit margins, and fair value into one place. This allows you to see exactly why you believe a stock is a buy, hold, or sell.

Narratives transform complex numbers into an actionable investment story that tracks how business performance and new information (like news, results, or risks) impact your personal forecast and estimated fair value. On Simply Wall St’s Community page, millions of investors can easily create and update their own Narratives for Bank of Nova Scotia, testing assumptions, comparing outcomes, and seeing how their views stack up alongside others.

This helps you confidently decide when a stock is undervalued or too expensive by comparing your calculated Fair Value with the current market price, automatically incorporating new developments as they happen. For example, some investors might build a Narrative that targets a future price of CA$94.0, based on bullish growth and margin assumptions, while others highlight more risks and see only CA$78.0 as justified. This reveals just how much your own outlook can shape your investment decisions.

Do you think there's more to the story for Bank of Nova Scotia? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives