The board of The Bank of Nova Scotia (TSE:BNS) has announced that it will pay a dividend of CA$0.90 per share on the 27th of October. Based on this payment, the dividend yield on the company's stock will be 4.5%, which is an attractive boost to shareholder returns.

See our latest analysis for Bank of Nova Scotia

Bank of Nova Scotia's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, Bank of Nova Scotia's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Looking forward, earnings per share is forecast to rise by 8.8% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 49% by next year, which is in a pretty sustainable range.

Bank of Nova Scotia Has A Solid Track Record

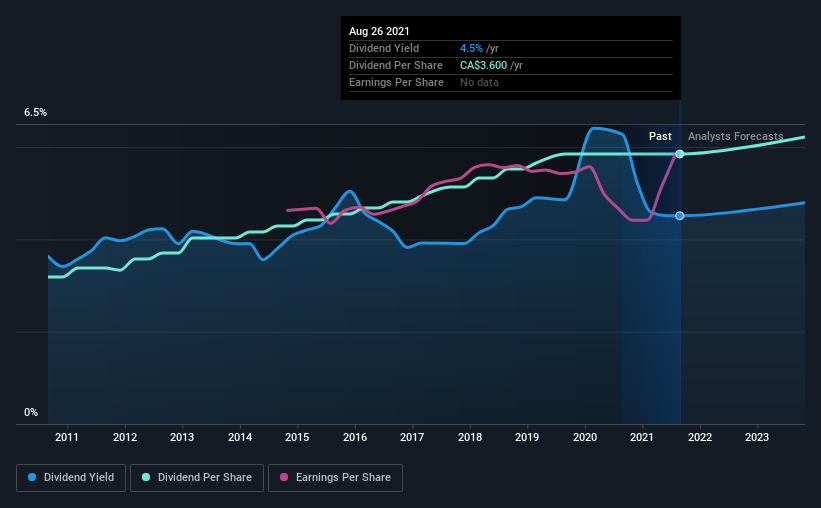

The company has an extended history of paying stable dividends. The dividend has gone from CA$1.96 in 2011 to the most recent annual payment of CA$3.60. This means that it has been growing its distributions at 6.3% per annum over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Dividend Growth May Be Hard To Achieve

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Earnings has been rising at 4.8% per annum over the last five years, which admittedly is a bit slow. Growth of 4.8% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This isn't necessarily bad, but we wouldn't expect rapid dividend growth in the future.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Earnings growth generally bodes well for the future value of company dividend payments. See if the 11 Bank of Nova Scotia analysts we track are forecasting continued growth with our free report on analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives