Bank of Nova Scotia (TSX:BNS) Eyes Growth in U.S. with Strategic KeyCorp Stake and Quebec Expansion

Reviewed by Simply Wall St

Bank of Nova Scotia (TSX:BNS) is currently facing a mix of promising opportunities and significant challenges. Recent developments include strategic investments aimed at market expansion and technological advancements, set against the backdrop of high credit costs and a need for improved profitability. In the discussion that follows, we will explore the bank's competitive advantages, vulnerabilities, potential areas for growth, and key risks, providing a comprehensive analysis of its current position.

Competitive Advantages That Elevate Bank of Nova Scotia

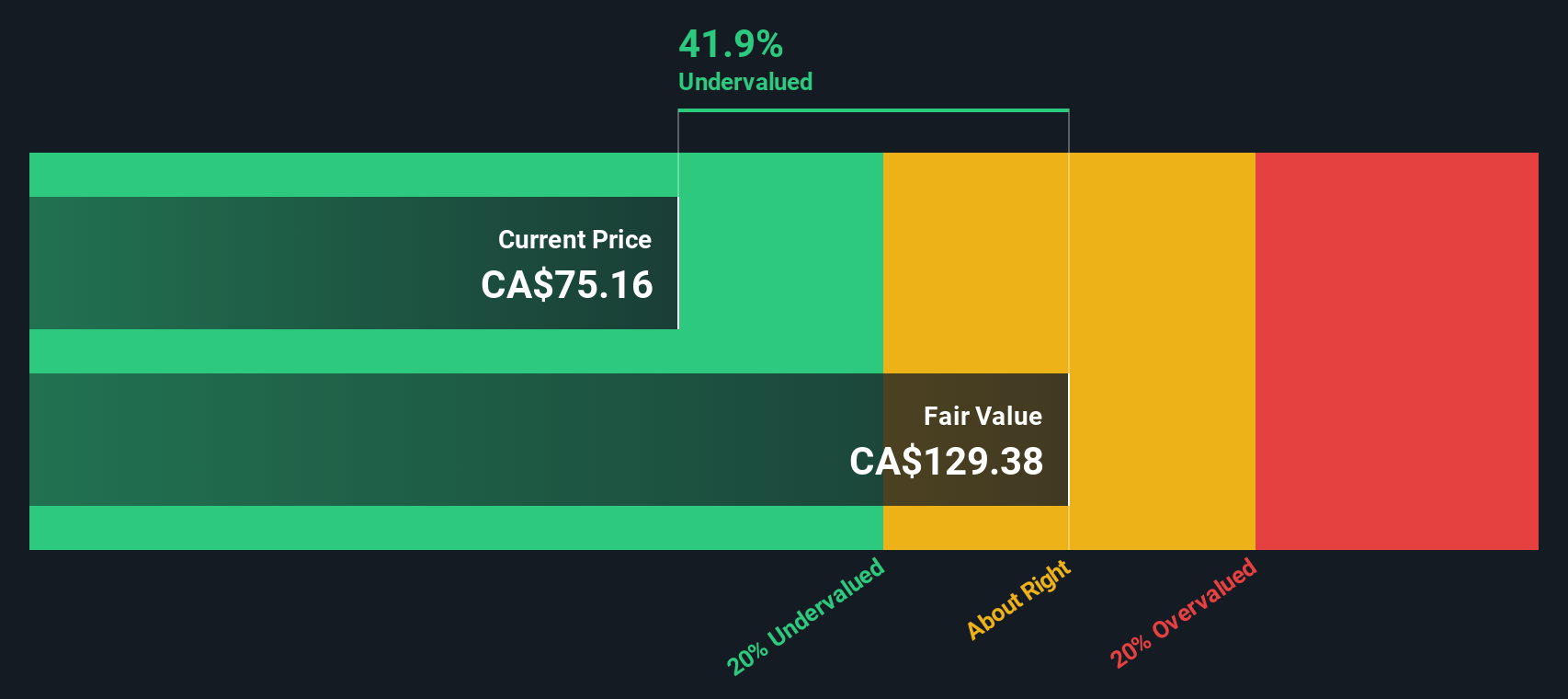

Strong financial health is evident in the Bank of Nova Scotia's balance sheet, with total assets of CA$1,402.4 billion and a sufficient allowance for bad loans at 0.8% of total loans. This financial strength is complemented by a strategic focus on capital discipline, as highlighted in the latest earnings call by Scott Thomson, President and CEO, who noted the bank's commitment to deploying capital to priority businesses. The bank's experienced management team, with an average tenure of 4.1 years, further supports its strategic objectives. Additionally, the bank's dividend payments, covered by earnings with a payout ratio of 73.2%, have been reliable and growing over the past decade. Despite being perceived as expensive compared to the North American Banks industry average, the bank is trading at CA$71.88, significantly below the estimated fair value of CA$134.78, indicating potential undervaluation.

Vulnerabilities Impacting Bank of Nova Scotia

Challenges include high credit costs and declining loan balances in international banking, as noted by Thomson. The bank's expense growth, driven by higher personnel costs and technology-related expenses, adds to these vulnerabilities. With a return on equity of 9.2%, considered low, the bank faces pressure to enhance profitability. Furthermore, the bank's earnings have not grown significantly, with a forecasted annual growth rate of 9%, slower than the Canadian market's 14.5%. The bank's price-to-earnings ratio of 12.6x, while favorable compared to peers, is higher than the North American Banks industry average of 11.4x, suggesting a need for improved cost management and operational efficiency.

Areas for Expansion and Innovation for Bank of Nova Scotia

Opportunities for growth are bolstered by strategic investments, such as the minority stake in KeyCorp, which aligns with the bank's market expansion goals in the U.S. banking sector. Technological advancements, including the ScotiaConnect cash management platform, are set to enhance capabilities in Mexico and Canada. The bank's focus on client growth initiatives, aiming for 1 million new primary clients in domestic retail, is expected to drive revenue growth. Additionally, the appointment of Jean-François Courville as President, Quebec, supports the bank's Grow Quebec strategy, offering potential for increased market penetration and enhanced service offerings across Canadian and global markets.

Key Risks and Challenges That Could Impact Bank of Nova Scotia's Success

Economic challenges, particularly the impact of interest rate increases on consumers, pose significant threats. Regulatory risks associated with strategic investments, such as the KeyCorp stake, require careful management to ensure compliance and maintain profitability. Competitive pressures, highlighted by Chief Risk Officer Philip Thomas, underline the need for vigilance in maintaining market share. Operational risks, especially in international markets like Colombia, demand strategic oversight to mitigate potential disruptions. These external factors necessitate a proactive approach to sustain growth and protect the bank's market position.

To gain deeper insights into Bank of Nova Scotia's historical performance, explore our detailed analysis of past performance. To dive deeper into how Bank of Nova Scotia's valuation metrics are shaping its market position, check out our detailed analysis of Bank of Nova Scotia's Valuation.Conclusion

Bank of Nova Scotia's strong financial position, evidenced by its substantial asset base and disciplined capital allocation, underpins its strategic growth initiatives. While challenges such as high credit costs and slow earnings growth persist, the bank's strategic investments and technological advancements offer pathways for future expansion, particularly in the U.S. and Canadian markets. The bank's current trading price of CA$71.88, well below its estimated fair value of CA$134.78, suggests potential for significant upside as it works to improve profitability and operational efficiency. This discrepancy between current trading price and fair value highlights an opportunity for investors, assuming the bank successfully navigates its challenges and capitalizes on its growth opportunities.

Summing It All Up

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives