Bank of Nova Scotia (TSX:BNS): Assessing Valuation After a 20% Three-Month Rally

Reviewed by Simply Wall St

Bank of Nova Scotia (TSX:BNS) has turned some heads recently as its stock delivered a 20% gain over the past three months. Investors are taking a closer look at what might be fueling this momentum and are considering the valuation outlook.

See our latest analysis for Bank of Nova Scotia.

That 20% jump over the quarter reflects a broader upswing. Bank of Nova Scotia’s total shareholder return is up nearly 32% over the past year, showing real momentum is building as investors re-evaluate the stock’s growth potential and risk profile.

If this wave of momentum has you curious about finding other opportunities, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But after such a sharp rally, is Bank of Nova Scotia actually trading below its true worth, or have recent gains already factored in the bank’s future prospects? Is this a new buying opportunity, or has the market already priced in the growth ahead?

Most Popular Narrative: 6.9% Overvalued

Bank of Nova Scotia’s share price has pushed above fair value according to the most widely followed narrative, with the latest close notably higher than its consensus estimate. The stage is set for a debate between those trusting in sustained growth and those wary of stretched valuations.

Expansion of banking and wealth management services in high-growth Pacific Alliance countries (Mexico, Peru, Chile, Colombia) positions BNS to capture revenue growth from increasing financial inclusion and rising middle-class demand for loans and investment products. This supports future top-line and earnings expansion.

What is driving such a punchy valuation? The behind-the-scenes math includes ambitious projections tied to international growth, margin improvements, and a powerful compounding effect. Want to see how these optimistic forecasts stack up, and what big numbers analysts are betting on? Dive in to see for yourself.

Result: Fair Value of $88.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty in Latin American markets and slow Canadian loan growth could quickly challenge the upbeat valuation narrative and shift investor sentiment.

Find out about the key risks to this Bank of Nova Scotia narrative.

Another View: Discounted Cash Flow Perspective

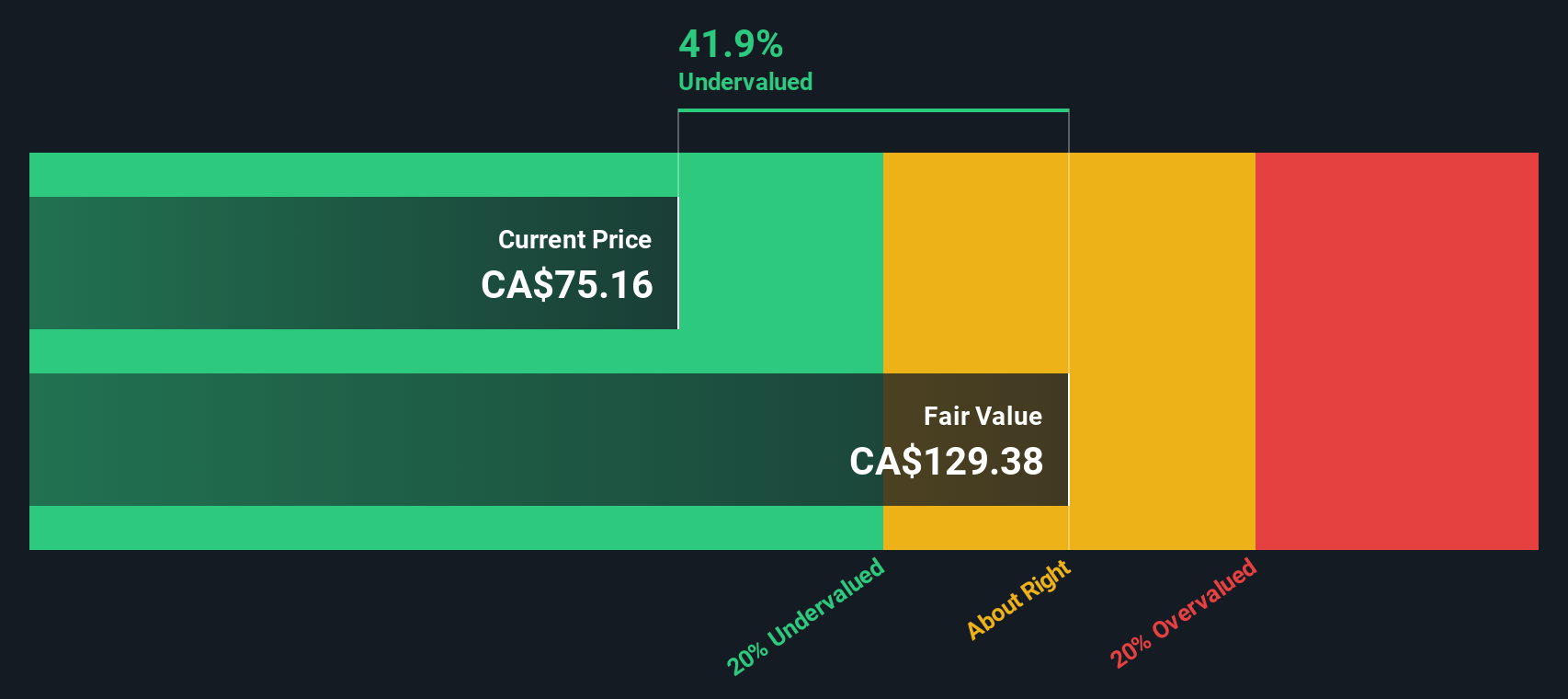

While many investors lean on price targets and earnings ratios, the SWS DCF model paints a much more optimistic picture for Bank of Nova Scotia. According to its cash flow projections, the shares are actually undervalued by a significant margin, which raises questions about whether there is overlooked upside in the current price. Could the market be missing something here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Nova Scotia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Nova Scotia Narrative

If you see things differently or want to run your own analysis, jump in and shape a narrative that fits your view in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Nova Scotia.

Looking for More Investment Ideas?

Why stop with just one opportunity? Uncover stocks with strong fundamentals, explosive trends, or income potential using the Simply Wall St Screener and set your portfolio apart from the crowd.

- Amplify your pursuit of tomorrow’s leaders by checking out these 26 AI penny stocks, which are positioned at the forefront of artificial intelligence and automation innovation.

- Supercharge your search for steady returns with these 15 dividend stocks with yields > 3%, showcasing companies that reward shareholders with robust dividend yields.

- Pounce on unique plays in digital assets through these 82 cryptocurrency and blockchain stocks, which are driving progress in blockchain and cryptocurrency breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives