Bank of Montreal (TSX:BMO): Valuation Insights Following New Bond Issuances and Canadian Depositary Receipts

Reviewed by Simply Wall St

Bank of Montreal (TSX:BMO) has been busy in the capital markets, announcing several new fixed-income offerings and rolling out fresh Canadian depositary receipts on the Cboe Canada exchange. This uptick in activity highlights an ongoing focus on broadening funding sources and investment options for clients.

See our latest analysis for Bank of Montreal.

Bank of Montreal’s multiple bond issuances and its latest slate of Canadian depositary receipts come on the heels of a strong run for shareholders, with total returns over the past year topping 35%. Momentum has picked up meaningfully, especially when considering the 121% five-year total return. This signals that investors are reacting positively to the bank’s ongoing capital and product initiatives.

If a mix of new offerings and market momentum has you keen to explore beyond the big banks, now's a great moment to discover fast growing stocks with high insider ownership.

But with shares now trading just below analyst targets and strong multi-year returns already achieved, investors are left wondering if this is the moment to buy Bank of Montreal at a relative value, or if future growth is already reflected in the price.

Most Popular Narrative: 1.2% Undervalued

With the most widely accepted narrative setting Bank of Montreal’s fair value just above its latest closing price, investor sentiment seems closely aligned with actual market activity. The small valuation gap highlights a balance between recent growth catalysts and a cautious outlook for what is next.

Demographic forces, including North American population growth, immigration, and urbanization, evidenced by robust checking account growth and deposit inflows, are underpinning sustained demand for BMO's retail, commercial, and wealth products. This is positioning the company for stable long-term revenue growth.

Curious about which bold projections make analysts so confident? One crucial assumption in this valuation could spell out whether BMO’s next chapter outperforms the market or disappoints. Dig in and uncover the full growth story behind this price target.

Result: Fair Value of $175.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued credit risks or a slowdown in Canadian economic growth could quickly undermine the current optimism surrounding Bank of Montreal’s outlook.

Find out about the key risks to this Bank of Montreal narrative.

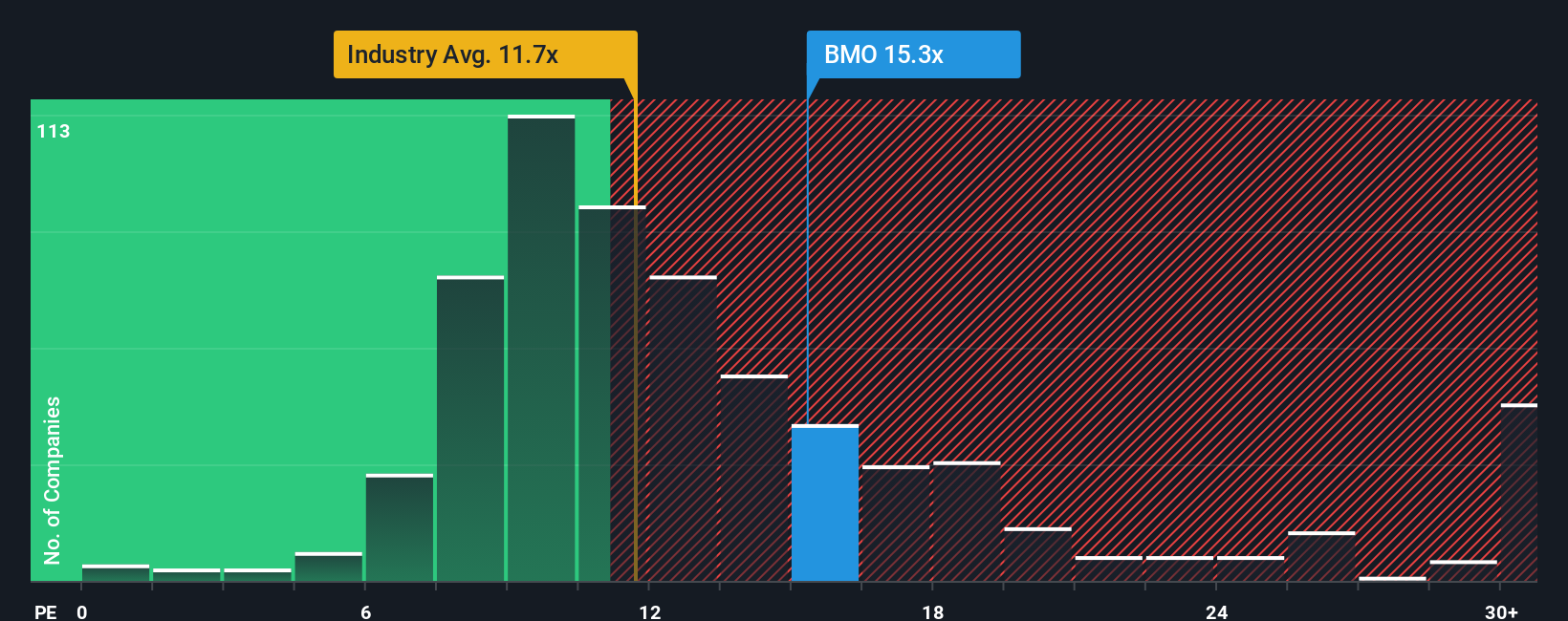

Another View: Relativity Risk With the Market Average

While the fair value estimate points to BMO being undervalued, its current price-to-earnings ratio of 14.9x stands well above both the North American bank industry average of 11.5x and nearly matches the peer average at 14.9x. In addition, it also slightly exceeds its own fair ratio of 14.6x. This suggests BMO’s shares carry a valuation premium, possibly reflecting confidence in future growth or quality, but also raising the risk that the price could be more vulnerable if expectations shift. Is the market bold, or just optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Montreal Narrative

If this narrative does not fit your outlook or you want to investigate the numbers personally, you can craft your own unique perspective quickly and easily by using Do it your way.

A great starting point for your Bank of Montreal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one strategy. Make the most of Simply Wall Street’s tools to uncover your next standout opportunity before others catch on.

- Capitalize on game-changing innovation by starting with these 25 AI penny stocks. Fast-moving companies are shaping tomorrow with artificial intelligence breakthroughs.

- Strengthen your portfolio’s potential for steady income and resilience by checking out these 14 dividend stocks with yields > 3%. This tool highlights high-yield achievers prioritizing shareholder returns.

- Tap into hidden value across the market with these 930 undervalued stocks based on cash flows and identify businesses priced for growth that others may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026