Assessing Bank of Montreal (TSX:BMO) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Bank of Montreal (TSX:BMO) shares have shown some movement recently, and investors are asking whether now could be an interesting time to re-evaluate their approach to the stock. Let’s look at key financial trends and value factors.

See our latest analysis for Bank of Montreal.

Bank of Montreal’s share price has gained noticeable momentum this year, rising 23.5% year-to-date and closing at $172.60. The one-year total shareholder return came in at an impressive 34.8%. The rally reflects growing investor confidence in the bank’s outlook as market sentiment has shifted after a stretch of mixed performance and periodic volatility. While not every week has been positive, the broader trend signals renewed optimism tied to the company’s growth prospects and improving fundamentals.

If you’re interested in what else is trending beyond the banks, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Bank of Montreal’s strong run, investors now face the key question: has the recent surge fully captured its value, or could there still be attractive upside left for those seeking a buying opportunity?

Most Popular Narrative: Fairly Valued

Bank of Montreal’s current market price stands just above the most widely followed narrative’s fair value estimate, suggesting that expectations have largely caught up with recent share price gains.

BMO's continued investment in digital and AI-powered banking platforms, such as the LUMI Assistant and multiple award-winning payment innovations, is improving operational efficiency and customer engagement. These developments are expected to drive increased net margins and persistently positive operating leverage.

Can a future built on AI, digital banking, and next-level customer engagement really justify today's valuation? This narrative hints at lucrative non-interest income growth and mounting efficiency. Discover the impressive growth assumptions and find out just how bullish analyst projections get.

Result: Fair Value of $171 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish economic growth and persistent credit risks could act as key catalysts that challenge the bank’s optimistic growth and profitability projections in the years ahead.

Find out about the key risks to this Bank of Montreal narrative.

Another View: Challenging the Market's Price

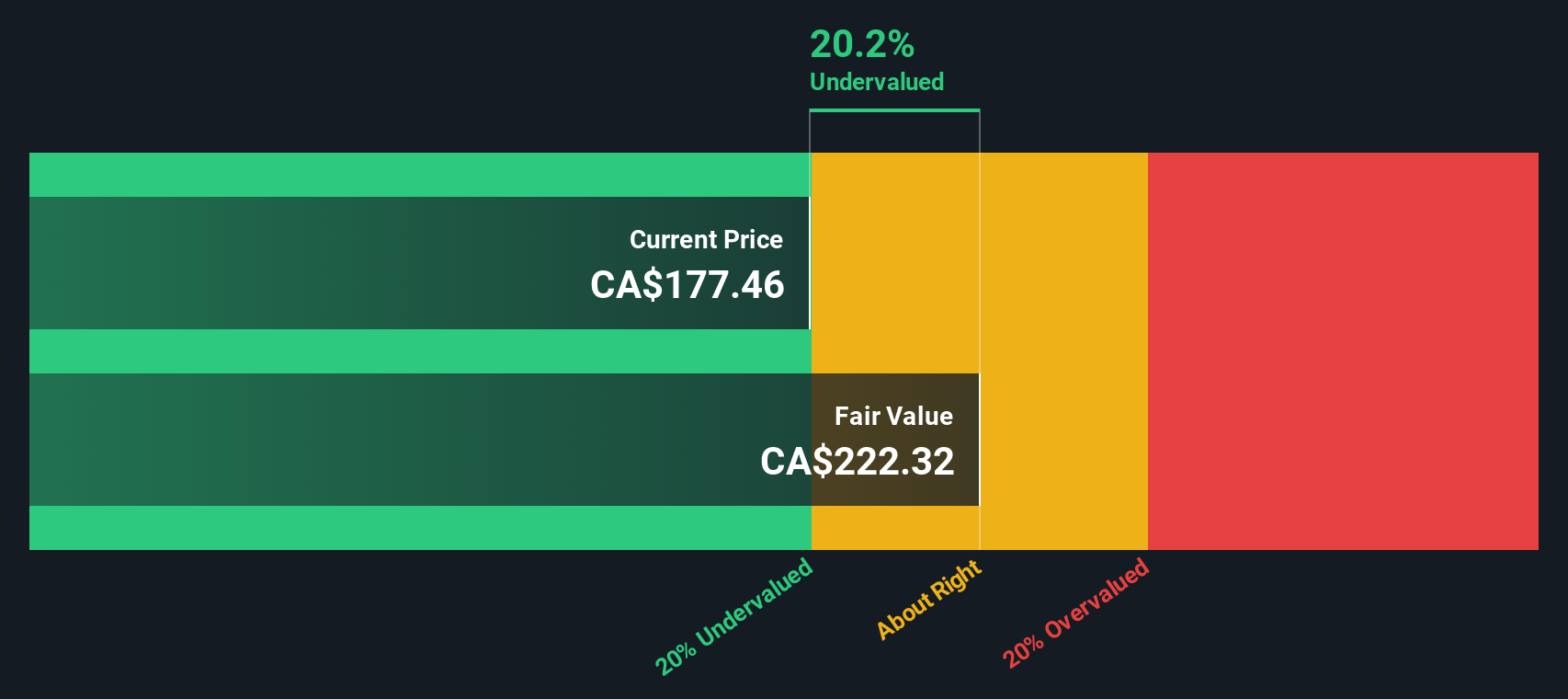

Even though analysts see Bank of Montreal as fairly valued at face value, our DCF model tells a different story. The SWS DCF model suggests the stock trades nearly 29% below its estimated fair value, which may indicate a potential undervaluation the market has not fully recognized. Could deeper growth and cash flow expectations unlock more upside than the consensus allows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Montreal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 100+ undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Montreal Narrative

If you see the story unfolding differently or believe your own analysis will lead you to fresh insights, you can piece together a personalized take on Bank of Montreal in just three minutes. Do it your way

A great starting point for your Bank of Montreal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for the ordinary when you could pinpoint bold growth, game-changing innovation, or steady income? Let Simply Wall Street’s powerful Screener open up smarter investment possibilities.

- Jump on breakthrough technology by following these 26 AI penny stocks, which are primed to reshape entire industries with artificial intelligence leadership.

- Secure reliable income with these 14 dividend stocks with yields > 3%, featuring companies known for strong yields and dependable payouts.

- Seize untapped value through these 100+ undervalued stocks based on cash flows, which the broader market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success