Exco Technologies Limited (TSE:XTC) has announced that it will pay a dividend of CA$0.10 per share on the 30th of September. This means the annual payment is 3.8% of the current stock price, which is above the average for the industry.

See our latest analysis for Exco Technologies

Exco Technologies' Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last dividend was quite easily covered by Exco Technologies' earnings. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 40.6%. If the dividend continues on this path, the payout ratio could be 37% by next year, which we think can be pretty sustainable going forward.

Exco Technologies Has A Solid Track Record

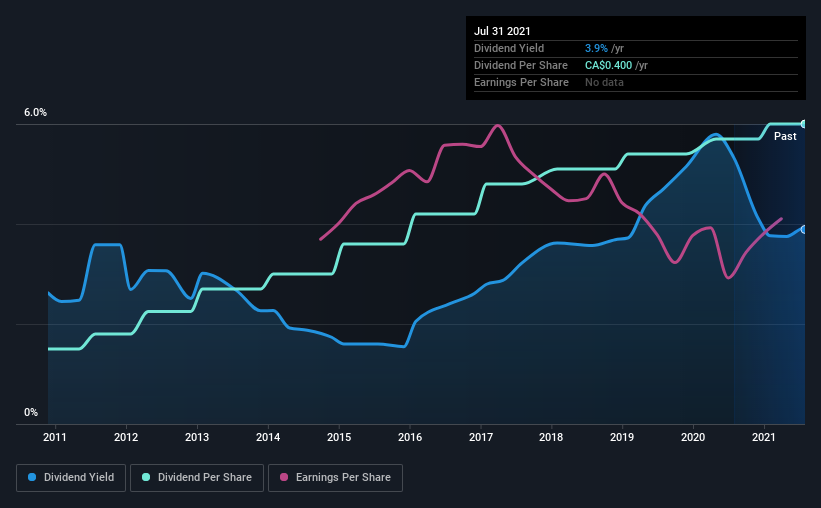

The company has an extended history of paying stable dividends. The first annual payment during the last 10 years was CA$0.10 in 2011, and the most recent fiscal year payment was CA$0.40. This means that it has been growing its distributions at 15% per annum over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth May Be Hard To Come By

Investors could be attracted to the stock based on the quality of its payment history. Let's not jump to conclusions as things might not be as good as they appear on the surface. In the last five years, Exco Technologies' earnings per share has shrunk at approximately 5.9% per annum. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Exco Technologies' Dividend

Overall, a consistent dividend is a good thing, and we think that Exco Technologies has the ability to continue this into the future. The earnings coverage is acceptable for now, but with earnings on the decline we would definitely keep an eye on the payout ratio. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Exco Technologies that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Exco Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:XTC

Exco Technologies

Designs, develops, manufactures, and sells dies, molds, components and assemblies, and consumable equipment for the die-cast, extrusion, and automotive industries.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success