- Canada

- /

- Auto Components

- /

- TSX:MRE

Market Still Lacking Some Conviction On Martinrea International Inc. (TSE:MRE)

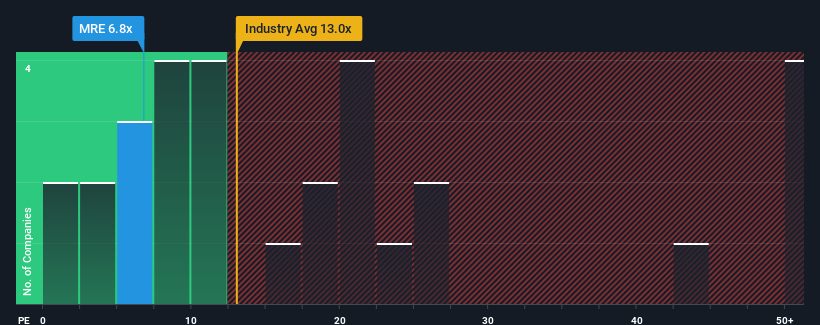

When close to half the companies in Canada have price-to-earnings ratios (or "P/E's") above 15x, you may consider Martinrea International Inc. (TSE:MRE) as a highly attractive investment with its 6.8x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Martinrea International hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Martinrea International

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Martinrea International's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 47%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 92% over the next year. With the market only predicted to deliver 23%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Martinrea International's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Martinrea International currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Martinrea International you should be aware of.

If these risks are making you reconsider your opinion on Martinrea International, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MRE

Martinrea International

Engages in the design, development, manufacture, and sale of engineered, value-added lightweight structures, and propulsion systems for automotive sector in North America, Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives