- Canada

- /

- Auto Components

- /

- TSX:MG

Magna International (TSX:MG) Valuation in Focus After Q3 Results, Raised Guidance and New Share Buyback

Reviewed by Simply Wall St

Magna International (TSX:MG) just reported its third quarter earnings and made a few key moves that investors are watching. Sales ticked up slightly, even as net income dropped from last year’s levels.

Alongside those results, Magna raised its full-year 2025 sales guidance, which signals renewed confidence for the months ahead. The board also authorized a fresh share buyback plan, and this could affect shareholder value going forward.

See our latest analysis for Magna International.

Magna International’s 1-month share price return of 15.7% points to building momentum, especially after its raised outlook and new buyback plan caught investors’ attention. Over the past year, shareholders have also enjoyed a total return of nearly 20%, which is a solid showing in a competitive market.

If you’re keeping an eye on auto stocks making moves, now is the perfect time to explore what’s happening across the industry with our See the full list for free.

But with shares up strongly in recent weeks, investors are left wondering if Magna is trading below its intrinsic value or if the recent rally already reflects all the good news, leaving limited upside from here.

Most Popular Narrative: 4.7% Overvalued

Magna International’s most popular narrative estimates a fair value just below the last close. With shares trading at CA$70.54, there is a subtle gap that hints at limited near-term upside based on consensus projections.

The company anticipates significant improvements in free cash flow due to the normalization of capital spending, particularly now that investments in battery enclosure assembly are behind them. Reduced CapEx will likely enhance free cash flow generation.

Wondering what hidden metrics boosted this valuation? The narrative hinges on shifting profit margins and bold revenue growth assumptions. Just one tweak could swing the entire fair value. Ready to uncover the forecast drivers and see what is really fueling analyst confidence?

Result: Fair Value of $67.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro pressures, including inflation and unpredictable auto production levels, could quickly reshape Magna’s valuation story moving forward.

Find out about the key risks to this Magna International narrative.

Another View: Looking at Value Through Earnings

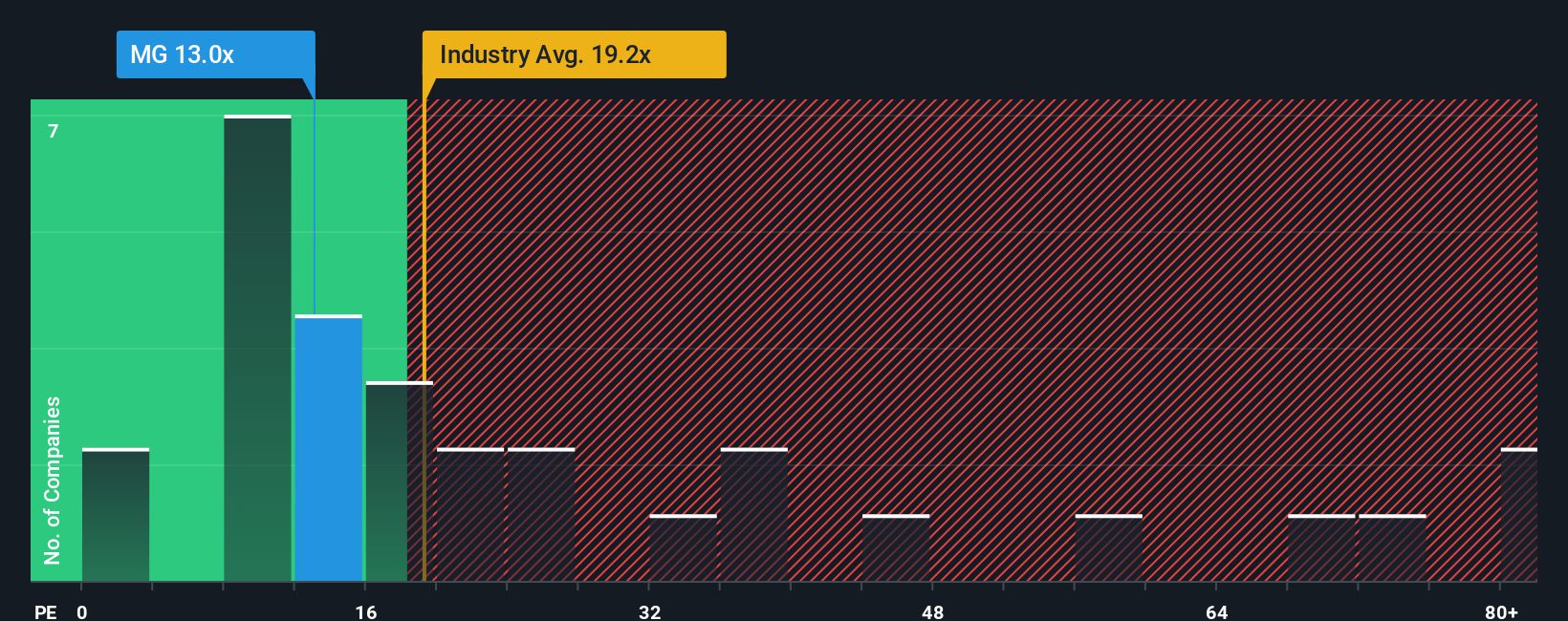

While the consensus narrative points to Magna International as slightly overvalued, our comparison using the price-to-earnings ratio paints a different picture. At 13.7x, Magna trades well below both its peer average of 26.1x and the wider North American industry’s 21.3x. This wide gap suggests potential value that the market could re-rate under the right conditions. Does the discount reflect hidden risks, or is it a real opportunity for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magna International Narrative

If you’re looking to dive deeper and prefer to draw your own conclusions, you can quickly build a personalized view backed by the latest numbers. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Magna International.

Looking for More Investment Ideas?

Get ahead of the crowd by acting on high-potential opportunities that others may overlook. Stay a step ahead and don’t let today’s smartest trends pass you by.

- Boost your portfolio income by tapping into these 14 dividend stocks with yields > 3% offering strong yields that consistently beat market averages.

- Capitalize on innovation by targeting these 25 AI penny stocks, which are at the forefront of artificial intelligence and tech breakthroughs.

- Unlock compelling value by targeting these 865 undervalued stocks based on cash flows, which are currently mispriced and ready for a potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MG

Magna International

Manufactures and supplies vehicle engineering, contract, and automotive space.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives