- Canada

- /

- Auto Components

- /

- TSX:MG

Assessing Magna International (TSX:MG) After Its Recent Share Price Rebound

Reviewed by Simply Wall St

Recent momentum in Magna International shares

Magna International (TSX:MG) has quietly climbed about 11% over the past month and roughly 24% year to date, a move that has investors asking whether this rebound still has room to run.

See our latest analysis for Magna International.

That recent 10.8% one month share price return and 24.2% year to date move suggests momentum is building as investors warm to Magna’s improving earnings trajectory and potential upside from vehicle electrification and advanced safety content.

If Magna’s run has you thinking more broadly about autos, this could be a good moment to explore other auto manufacturers that might fit your watchlist next.

With earnings recovering, a solid value score, and shares trading near analyst targets yet still at a sizable intrinsic discount, are investors looking at a fresh buying opportunity, or is the market already pricing in Magna’s next leg of growth?

Most Popular Narrative Narrative: 6.4% Overvalued

With Magna International last closing at CA$73.82 against a narrative fair value of about CA$69.38, the current share price sits slightly ahead of the long term roadmap embedded in consensus assumptions.

The analysts have a consensus price target of CA$65.906 for Magna International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$80.21, and the most bearish reporting a price target of just CA$54.51.

Want to see what kind of margin lift, earnings climb, and valuation reset analysts are baking in to justify this gap? The full narrative unpacks the exact growth path they are betting on, how capital intensity shifts, and why the future earnings multiple they use looks more conservative than many past cycles. Curious which of those moving parts does the heavy lifting in that fair value math? Read on to see the assumptions driving every dollar of that projected upside.

Result: Fair Value of $69.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro headwinds, including weaker vehicle production and persistent inflation-driven cost pressures, could quickly undermine the margin gains analysts currently expect.

Find out about the key risks to this Magna International narrative.

Another Lens on Value

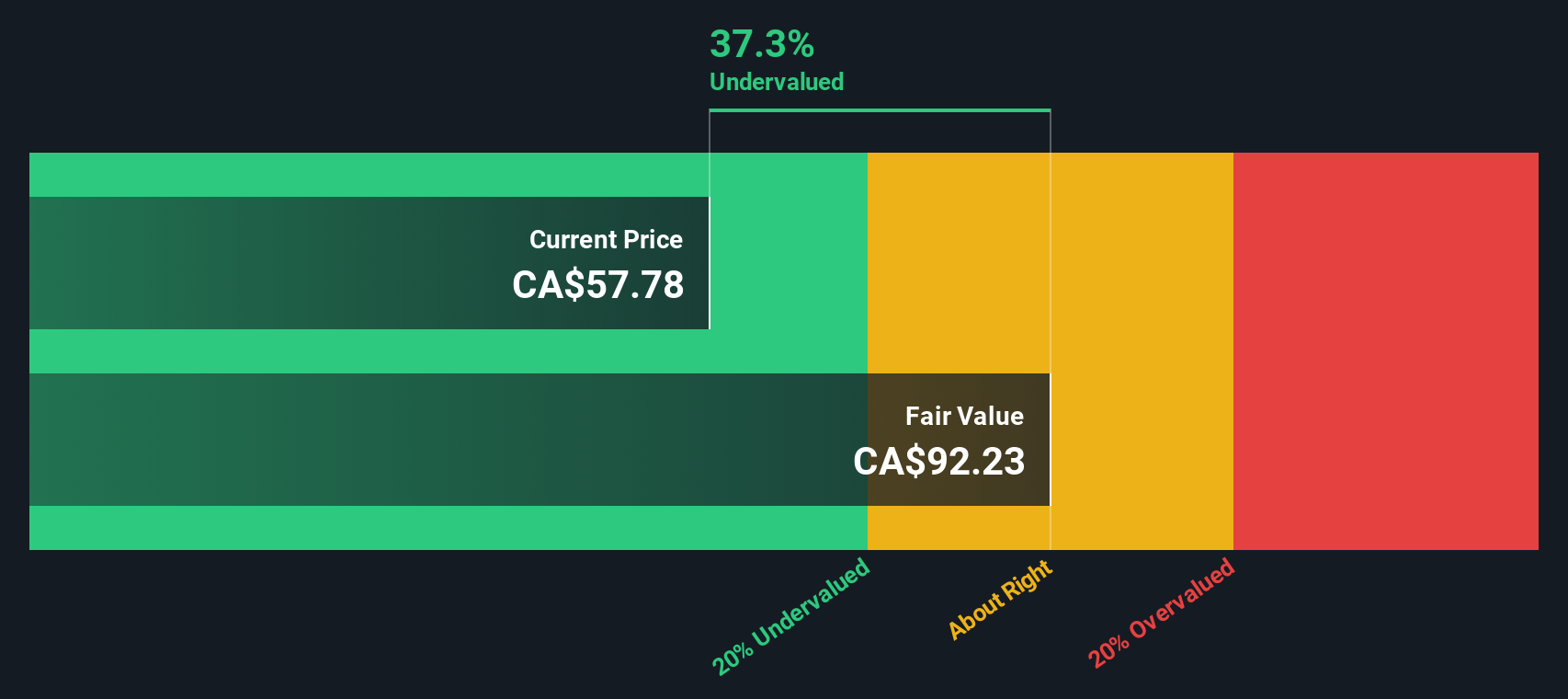

While the consensus narrative suggests Magna is about 6% overvalued, our DCF model points the other way. Shares are trading roughly 21% below an estimated fair value of around CA$93.50. Is the market underestimating cash flow potential, or are the narrative assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Magna International Narrative

If this interpretation does not line up with your own view, or you prefer digging into the numbers yourself, you can build a custom Magna thesis in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Magna International.

Looking for more investment ideas?

Before the market moves without you, use the Simply Wall Street Screener to pinpoint fresh opportunities that match your strategy and sharpen your next investing decision.

- Capture early stage momentum by tracking these 3629 penny stocks with strong financials that pair small market caps with improving fundamentals and room for significant re rating.

- Position your portfolio for the next productivity wave by targeting these 24 AI penny stocks that are embedding intelligent automation into real world businesses.

- Identify value focused opportunities by zeroing in on these 918 undervalued stocks based on cash flows where current prices sit well below long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MG

Magna International

Manufactures and supplies vehicle engineering, contract, and automotive space.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion