- Brazil

- /

- Water Utilities

- /

- BOVESPA:SBSP3

Here's What To Make Of Companhia de Saneamento Básico do Estado de São Paulo - SABESP's (BVMF:SBSP3) Decelerating Rates Of Return

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So, when we ran our eye over Companhia de Saneamento Básico do Estado de São Paulo - SABESP's (BVMF:SBSP3) trend of ROCE, we liked what we saw.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Companhia de Saneamento Básico do Estado de São Paulo - SABESP, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = R$4.5b ÷ (R$50b - R$5.9b) (Based on the trailing twelve months to December 2020).

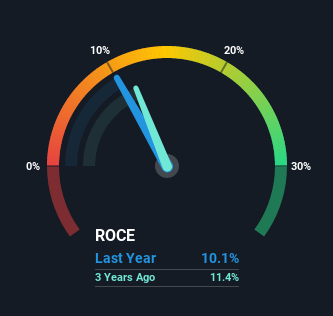

Thus, Companhia de Saneamento Básico do Estado de São Paulo - SABESP has an ROCE of 10%. That's a relatively normal return on capital, and it's around the 8.9% generated by the Water Utilities industry.

See our latest analysis for Companhia de Saneamento Básico do Estado de São Paulo - SABESP

Above you can see how the current ROCE for Companhia de Saneamento Básico do Estado de São Paulo - SABESP compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

The Trend Of ROCE

The trend of ROCE doesn't stand out much, but returns on a whole are decent. Over the past five years, ROCE has remained relatively flat at around 10% and the business has deployed 49% more capital into its operations. 10% is a pretty standard return, and it provides some comfort knowing that Companhia de Saneamento Básico do Estado de São Paulo - SABESP has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

What We Can Learn From Companhia de Saneamento Básico do Estado de São Paulo - SABESP's ROCE

In the end, Companhia de Saneamento Básico do Estado de São Paulo - SABESP has proven its ability to adequately reinvest capital at good rates of return. Therefore it's no surprise that shareholders have earned a respectable 78% return if they held over the last five years. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

On a final note, we've found 2 warning signs for Companhia de Saneamento Básico do Estado de São Paulo - SABESP that we think you should be aware of.

While Companhia de Saneamento Básico do Estado de São Paulo - SABESP may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:SBSP3

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

Provides basic and environmental sanitation services in the São Paulo State, Brazil.

Outstanding track record and fair value.