- Brazil

- /

- Electric Utilities

- /

- BOVESPA:GEPA3

If You Had Bought Rio Paranapanema Energia's (BVMF:GEPA3) Shares A Year Ago You Would Be Down 13%

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Rio Paranapanema Energia S.A. (BVMF:GEPA3) share price slid 13% over twelve months. That's disappointing when you consider the market declined 2.6%. The silver lining (for longer term investors) is that the stock is still 10% higher than it was three years ago. The good news is that the stock is up 3.3% in the last week.

View our latest analysis for Rio Paranapanema Energia

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

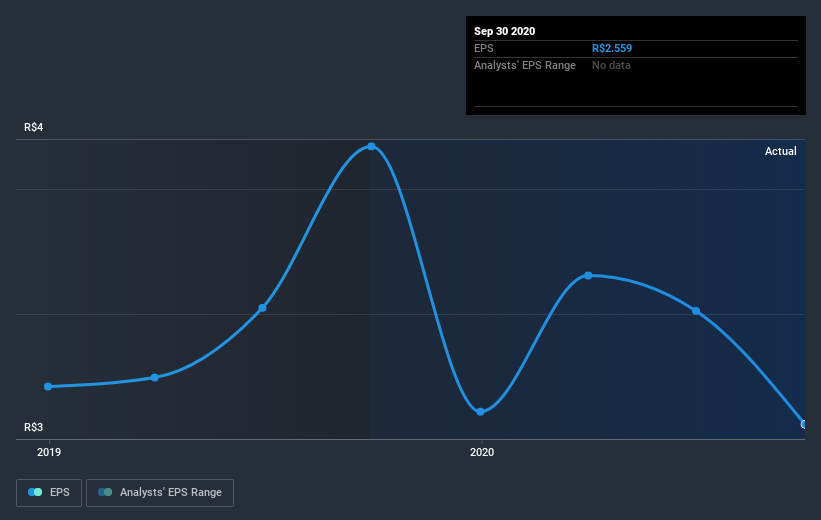

Unhappily, Rio Paranapanema Energia had to report a 30% decline in EPS over the last year. This fall in the EPS is significantly worse than the 13% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Rio Paranapanema Energia's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Rio Paranapanema Energia shareholders, and that cash payout explains why its total shareholder loss of 8.6%, over the last year, isn't as bad as the share price return.

A Different Perspective

The last twelve months weren't great for Rio Paranapanema Energia shares, which cost holders 8.6%, while the market was up about 2.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 11% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Rio Paranapanema Energia better, we need to consider many other factors. Even so, be aware that Rio Paranapanema Energia is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you’re looking to trade Rio Paranapanema Energia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:GEPA3

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives