- Brazil

- /

- Electric Utilities

- /

- BOVESPA:ENGI3

Energisa (BVMF:ENGI3) investors are sitting on a loss of 23% if they invested a year ago

Energisa S.A. (BVMF:ENGI3) shareholders should be happy to see the share price up 15% in the last month. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 25% in the last year, well below the market return.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Energisa

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Energisa share price fell, it actually saw its earnings per share (EPS) improve by 27%. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

Energisa managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

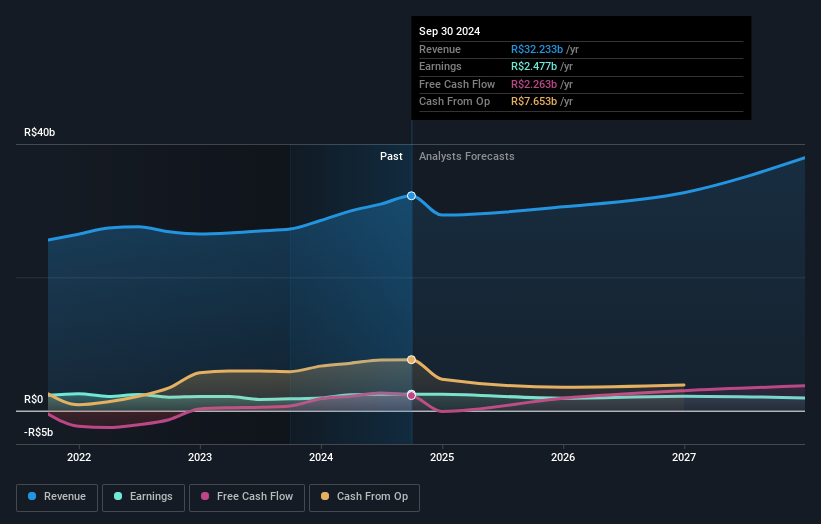

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Energisa is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Energisa stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market lost about 0.2% in the twelve months, Energisa shareholders did even worse, losing 23% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 1.7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Energisa has 1 warning sign we think you should be aware of.

We will like Energisa better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Energisa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ENGI3

Energisa

Through its subsidiaries, engages in the distribution, transmission, and generation of electricity in Brazil.

Solid track record and fair value.

Market Insights

Community Narratives