- Brazil

- /

- Electric Utilities

- /

- BOVESPA:ENBR3

Time To Worry? Analysts Just Downgraded Their EDP - Energias do Brasil S.A. (BVMF:ENBR3) Outlook

One thing we could say about the analysts on EDP - Energias do Brasil S.A. (BVMF:ENBR3) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

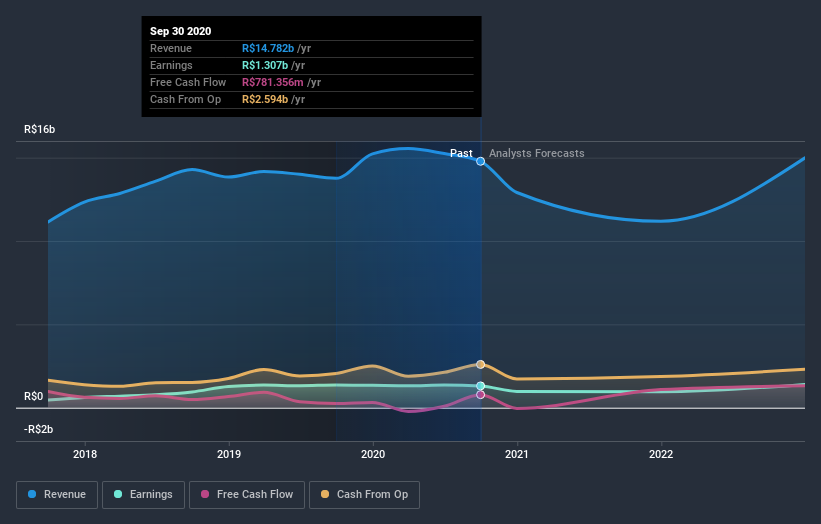

Following the downgrade, the consensus from six analysts covering EDP - Energias do Brasil is for revenues of R$11b in 2021, implying a stressful 24% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of R$14b in 2021. The consensus view seems to have become more pessimistic on EDP - Energias do Brasil, noting the substantial drop in revenue estimates in this update.

See our latest analysis for EDP - Energias do Brasil

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the EDP - Energias do Brasil's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 24% by the end of 2021. This indicates a significant reduction from annual growth of 11% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 1.8% annually for the foreseeable future. It's pretty clear that EDP - Energias do Brasil's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for EDP - Energias do Brasil this year. They also expect company revenue to perform worse than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on EDP - Energias do Brasil after today.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

When trading EDP - Energias do Brasil or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EDP - Energias do Brasil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:ENBR3

EDP - Energias do Brasil

EDP - Energias do Brasil S.A. operates in the energy sector in Brazil.

Moderate growth potential second-rate dividend payer.

Market Insights

Community Narratives