- Brazil

- /

- Water Utilities

- /

- BOVESPA:CSMG3

Is Companhia de Saneamento de Minas Gerais' (BVMF:CSMG3) Latest Stock Performance A Reflection Of Its Financial Health?

Most readers would already be aware that Companhia de Saneamento de Minas Gerais' (BVMF:CSMG3) stock increased significantly by 35% over the past three months. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Companhia de Saneamento de Minas Gerais' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Companhia de Saneamento de Minas Gerais is:

16% = R$1.4b ÷ R$8.6b (Based on the trailing twelve months to September 2025).

The 'return' is the yearly profit. One way to conceptualize this is that for each R$1 of shareholders' capital it has, the company made R$0.16 in profit.

See our latest analysis for Companhia de Saneamento de Minas Gerais

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Companhia de Saneamento de Minas Gerais' Earnings Growth And 16% ROE

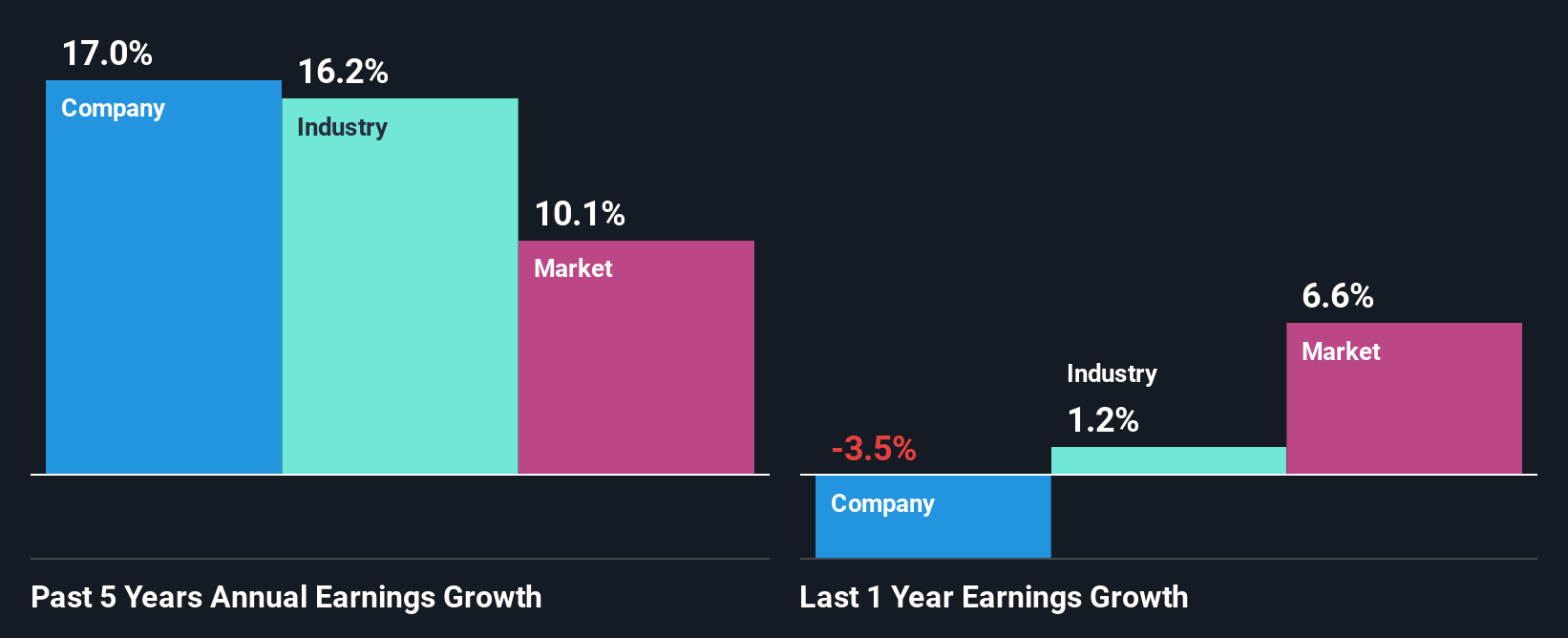

On the face of it, Companhia de Saneamento de Minas Gerais' ROE is not much to talk about. However, the fact that the company's ROE is higher than the average industry ROE of 9.7%, is definitely interesting. Consequently, this likely laid the ground for the decent growth of 17% seen over the past five years by Companhia de Saneamento de Minas Gerais. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. So there might well be other reasons for the earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

As a next step, we compared Companhia de Saneamento de Minas Gerais' net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 16% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. What is CSMG3 worth today? The intrinsic value infographic in our free research report helps visualize whether CSMG3 is currently mispriced by the market.

Is Companhia de Saneamento de Minas Gerais Using Its Retained Earnings Effectively?

Companhia de Saneamento de Minas Gerais has a three-year median payout ratio of 46%, which implies that it retains the remaining 54% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Besides, Companhia de Saneamento de Minas Gerais has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 35% over the next three years. Regardless, the ROE is not expected to change much for the company despite the lower expected payout ratio.

Summary

In total, we are pretty happy with Companhia de Saneamento de Minas Gerais' performance. In particular, it's great to see that the company has seen significant growth in its earnings backed by a respectable ROE and a high reinvestment rate. That being so, according to the latest industry analyst forecasts, the company's earnings are expected to shrink in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CSMG3

Companhia de Saneamento de Minas Gerais

Plans, executes, expands, remodels, and explores public services, basic sanitation, water supply, sewage, sanitary, and solid waste in Brazil and internationally.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success