- Brazil

- /

- Transportation

- /

- BOVESPA:SIMH3

SIMPAR S.A. (BVMF:SIMH3) Stock Rockets 26% But Many Are Still Ignoring The Company

SIMPAR S.A. (BVMF:SIMH3) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

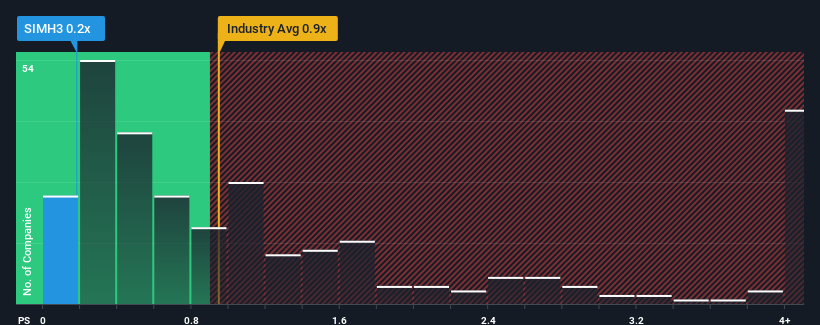

Although its price has surged higher, it would still be understandable if you think SIMPAR is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Brazil's Transportation industry have P/S ratios above 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for SIMPAR

How Has SIMPAR Performed Recently?

SIMPAR's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on SIMPAR will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on SIMPAR will help you uncover what's on the horizon.How Is SIMPAR's Revenue Growth Trending?

SIMPAR's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Pleasingly, revenue has also lifted 233% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 22% over the next year. Meanwhile, the rest of the industry is forecast to expand by 24%, which is not materially different.

With this information, we find it odd that SIMPAR is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On SIMPAR's P/S

SIMPAR's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of SIMPAR's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for SIMPAR (1 shouldn't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:SIMH3

SIMPAR

Provides light vehicle rental, and fleet management and outsourcing services in Brazil.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives