The Market Lifts Sequoia Logística e Transportes S.A. (BVMF:SEQL3) Shares 80% But It Can Do More

Sequoia Logística e Transportes S.A. (BVMF:SEQL3) shareholders would be excited to see that the share price has had a great month, posting a 80% gain and recovering from prior weakness. But the last month did very little to improve the 73% share price decline over the last year.

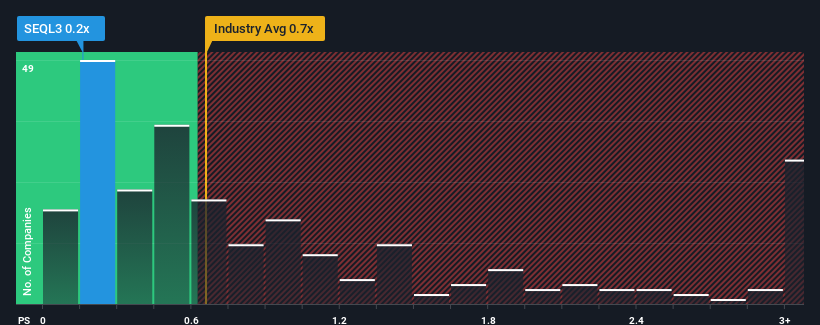

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sequoia Logística e Transportes' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Logistics industry in Brazil is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sequoia Logística e Transportes

How Has Sequoia Logística e Transportes Performed Recently?

With revenue that's retreating more than the industry's average of late, Sequoia Logística e Transportes has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Sequoia Logística e Transportes will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Sequoia Logística e Transportes' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 99% over the next year. With the industry only predicted to deliver 2.7%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Sequoia Logística e Transportes is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Sequoia Logística e Transportes' P/S

Sequoia Logística e Transportes' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Sequoia Logística e Transportes' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for Sequoia Logística e Transportes (3 make us uncomfortable!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SEQL3

Sequoia Logística e Transportes

Provides logistics, warehouse, transportation, supply chain, and operation management services.

Moderate risk and good value.

Market Insights

Community Narratives