Sequoia Logística e Transportes S.A.'s (BVMF:SEQL3) Price Is Right But Growth Is Lacking After Shares Rocket 64%

Sequoia Logística e Transportes S.A. (BVMF:SEQL3) shareholders would be excited to see that the share price has had a great month, posting a 64% gain and recovering from prior weakness. But the last month did very little to improve the 68% share price decline over the last year.

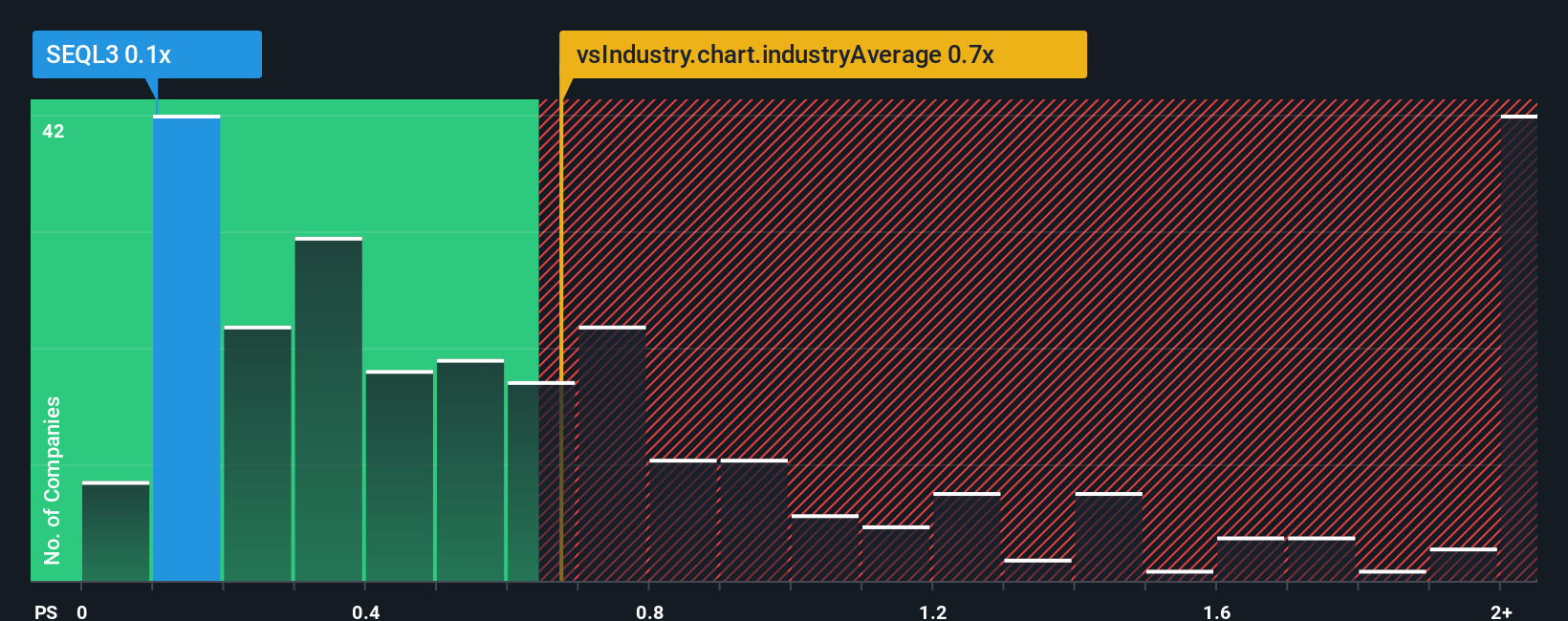

Even after such a large jump in price, when close to half the companies operating in Brazil's Logistics industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider Sequoia Logística e Transportes as an enticing stock to check out with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Sequoia Logística e Transportes

What Does Sequoia Logística e Transportes' P/S Mean For Shareholders?

The recent revenue growth at Sequoia Logística e Transportes would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sequoia Logística e Transportes will help you shine a light on its historical performance.How Is Sequoia Logística e Transportes' Revenue Growth Trending?

Sequoia Logística e Transportes' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 3.3% gain to the company's revenues. Still, lamentably revenue has fallen 49% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.9% shows it's an unpleasant look.

With this in mind, we understand why Sequoia Logística e Transportes' P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Sequoia Logística e Transportes' P/S

Despite Sequoia Logística e Transportes' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sequoia Logística e Transportes confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Sequoia Logística e Transportes (of which 4 are a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SEQL3

Sequoia Logística e Transportes

Provides logistics, warehouse, transportation, supply chain, and operation management services.

Moderate risk and good value.

Market Insights

Community Narratives