- Brazil

- /

- Infrastructure

- /

- BOVESPA:ECOR3

EcoRodovias Infraestrutura e Logística's (BVMF:ECOR3) 43% CAGR outpaced the company's earnings growth over the same three-year period

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the EcoRodovias Infraestrutura e Logística S.A. (BVMF:ECOR3) share price is 171% higher than it was three years ago. That sort of return is as solid as granite. On top of that, the share price is up 37% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Since it's been a strong week for EcoRodovias Infraestrutura e Logística shareholders, let's have a look at trend of the longer term fundamentals.

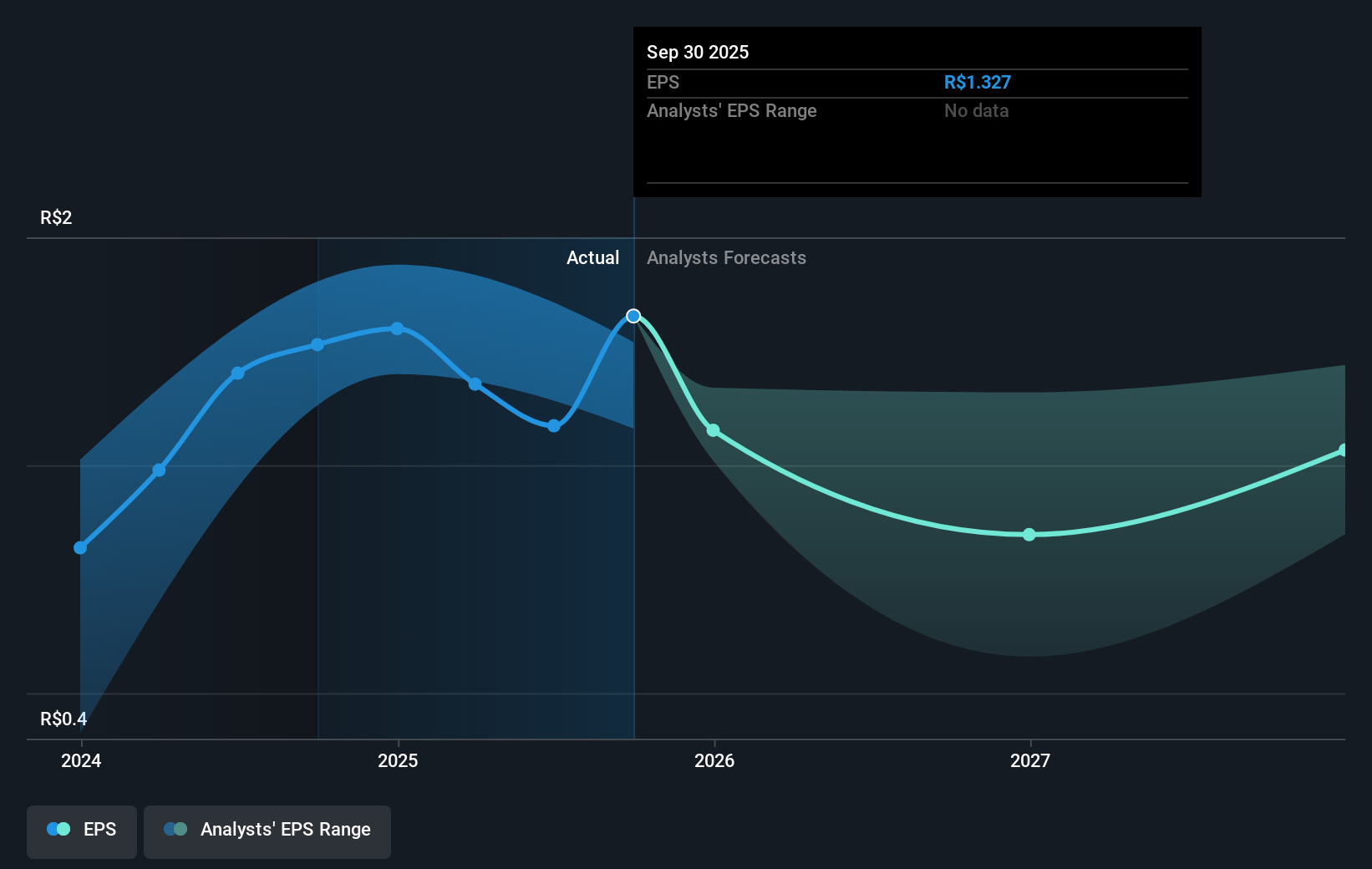

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

EcoRodovias Infraestrutura e Logística was able to grow its EPS at 83% per year over three years, sending the share price higher. This EPS growth is higher than the 39% average annual increase in the share price. So it seems investors have become more cautious about the company, over time. This cautious sentiment is reflected in its (fairly low) P/E ratio of 8.15.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that EcoRodovias Infraestrutura e Logística has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of EcoRodovias Infraestrutura e Logística, it has a TSR of 194% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that EcoRodovias Infraestrutura e Logística has rewarded shareholders with a total shareholder return of 114% in the last twelve months. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 1.6% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for EcoRodovias Infraestrutura e Logística you should be aware of, and 2 of them make us uncomfortable.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EcoRodovias Infraestrutura e Logística might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ECOR3

EcoRodovias Infraestrutura e Logística

EcoRodovias Infraestrutura e Logística S.A.

Fair value with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026