- Brazil

- /

- Infrastructure

- /

- BOVESPA:ECOR3

EcoRodovias Infraestrutura e Logística S.A.'s (BVMF:ECOR3) 28% Share Price Surge Not Quite Adding Up

EcoRodovias Infraestrutura e Logística S.A. (BVMF:ECOR3) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 42%.

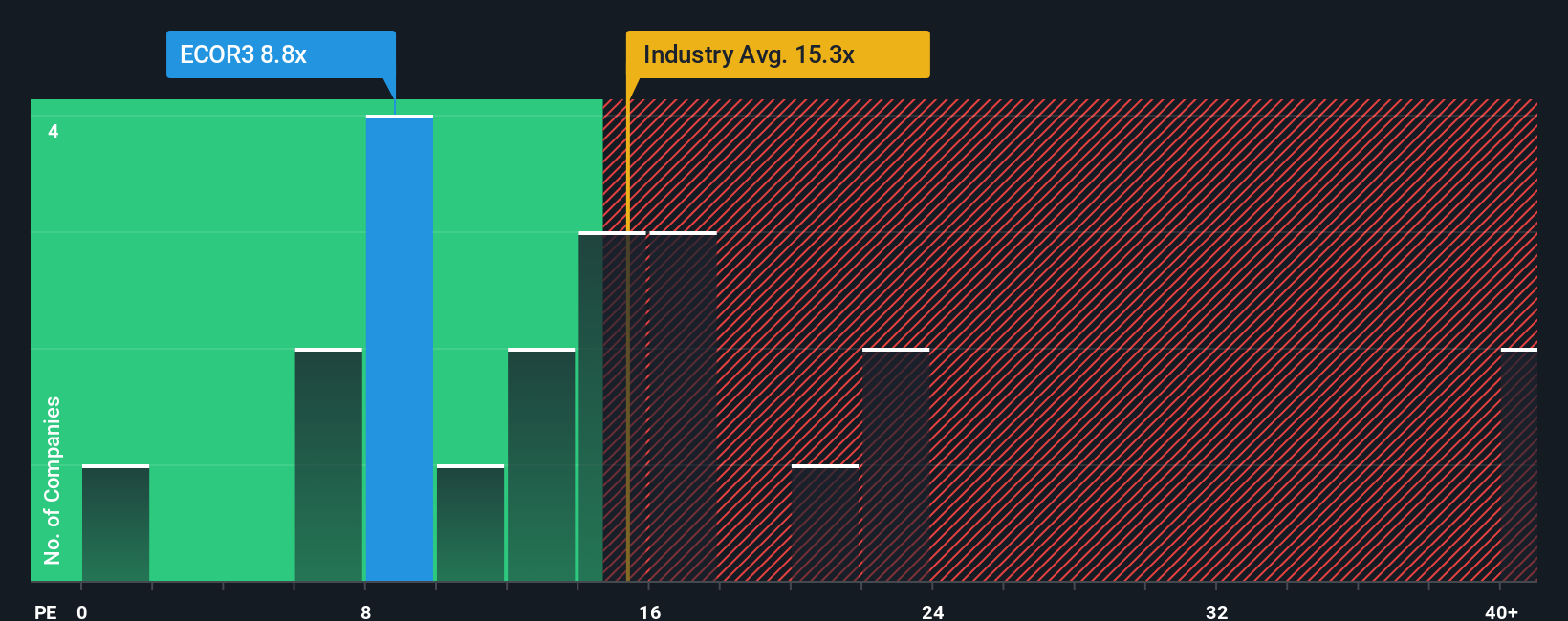

Although its price has surged higher, you could still be forgiven for feeling indifferent about EcoRodovias Infraestrutura e Logística's P/E ratio of 8.8x, since the median price-to-earnings (or "P/E") ratio in Brazil is also close to 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

EcoRodovias Infraestrutura e Logística hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for EcoRodovias Infraestrutura e Logística

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, EcoRodovias Infraestrutura e Logística would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 9.6%. Still, the latest three year period has seen an excellent 357% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 7.2% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 16% per year, which is noticeably more attractive.

In light of this, it's curious that EcoRodovias Infraestrutura e Logística's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From EcoRodovias Infraestrutura e Logística's P/E?

EcoRodovias Infraestrutura e Logística appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of EcoRodovias Infraestrutura e Logística's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 3 warning signs for EcoRodovias Infraestrutura e Logística (2 are potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EcoRodovias Infraestrutura e Logística might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ECOR3

EcoRodovias Infraestrutura e Logística

EcoRodovias Infraestrutura e Logística S.A.

Low risk and slightly overvalued.

Market Insights

Community Narratives