- Brazil

- /

- Communications

- /

- BOVESPA:WDCN3

Benign Growth For Livetech da Bahia Indústria e Comércio S.A. (BVMF:LVTC3) Underpins Stock's 26% Plummet

Unfortunately for some shareholders, the Livetech da Bahia Indústria e Comércio S.A. (BVMF:LVTC3) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

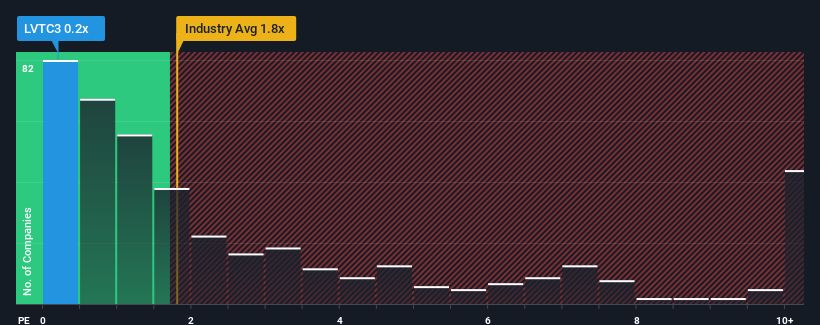

Although its price has dipped substantially, Livetech da Bahia Indústria e Comércio's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Communications industry in Brazil, where around half of the companies have P/S ratios above 1.8x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Livetech da Bahia Indústria e Comércio

How Livetech da Bahia Indústria e Comércio Has Been Performing

As an illustration, revenue has deteriorated at Livetech da Bahia Indústria e Comércio over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Livetech da Bahia Indústria e Comércio, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Livetech da Bahia Indústria e Comércio's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Livetech da Bahia Indústria e Comércio's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. As a result, revenue from three years ago have also fallen 17% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Livetech da Bahia Indústria e Comércio's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Livetech da Bahia Indústria e Comércio's P/S

Livetech da Bahia Indústria e Comércio's recently weak share price has pulled its P/S back below other Communications companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Livetech da Bahia Indústria e Comércio confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for Livetech da Bahia Indústria e Comércio you should be aware of, and 3 of them are a bit unpleasant.

If these risks are making you reconsider your opinion on Livetech da Bahia Indústria e Comércio, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:WDCN3

Livetech da Bahia Indústria e Comércio

Provides technology-as-a-service solutions and services in Brazil and internationally.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives