- Brazil

- /

- Specialty Stores

- /

- BOVESPA:AMAR3

Marisa Lojas S.A.'s (BVMF:AMAR3) Share Price Not Quite Adding Up

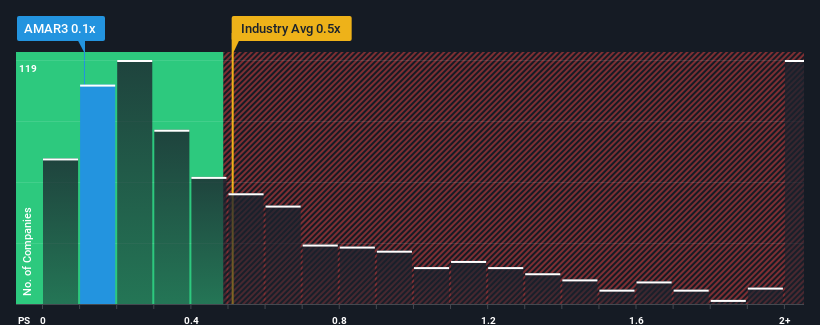

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Specialty Retail industry in Brazil, you could be forgiven for feeling indifferent about Marisa Lojas S.A.'s (BVMF:AMAR3) P/S ratio of 0.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Marisa Lojas

What Does Marisa Lojas' P/S Mean For Shareholders?

Recent times haven't been great for Marisa Lojas as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Marisa Lojas.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Marisa Lojas' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 4.2% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 13% as estimated by the two analysts watching the company. Meanwhile, the broader industry is forecast to expand by 1.3%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Marisa Lojas' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Marisa Lojas' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While Marisa Lojas' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You need to take note of risks, for example - Marisa Lojas has 3 warning signs (and 1 which is significant) we think you should know about.

If these risks are making you reconsider your opinion on Marisa Lojas, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AMAR3

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives