- Brazil

- /

- Real Estate

- /

- BOVESPA:FIEI3

Shareholders Of CR2 Empreendimentos Imobiliários (BVMF:CRDE3) Have Received 11% On Their Investment

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by CR2 Empreendimentos Imobiliários S.A. (BVMF:CRDE3) shareholders over the last year, as the share price declined 36%. That's disappointing when you consider the market returned 28%. At least the damage isn't so bad if you look at the last three years, since the stock is down 22% in that time. More recently, the share price has dropped a further 21% in a month. But this could be related to poor market conditions -- stocks are down 9.3% in the same time.

Check out our latest analysis for CR2 Empreendimentos Imobiliários

CR2 Empreendimentos Imobiliários isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year CR2 Empreendimentos Imobiliários saw its revenue fall by 78%. If you think that's a particularly bad result, you're statistically on the money No surprise, then, that the share price fell 36% over the year. We would want to see improvements in the core business, and diminishing losses, before getting too excited about this one.

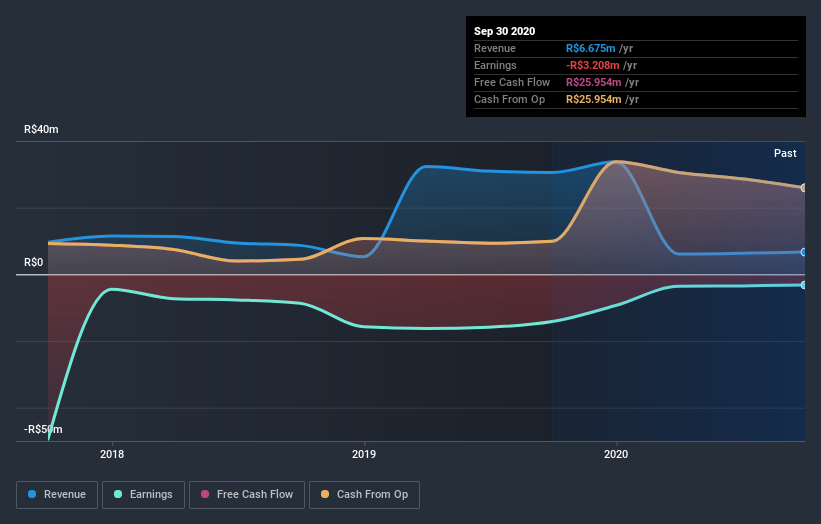

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling CR2 Empreendimentos Imobiliários stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered CR2 Empreendimentos Imobiliários' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for CR2 Empreendimentos Imobiliários shareholders, and that cash payout contributed to why its TSR of 11%, over the last year, is better than the share price return.

A Different Perspective

CR2 Empreendimentos Imobiliários shareholders gained a total return of 11% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 4% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand CR2 Empreendimentos Imobiliários better, we need to consider many other factors. For instance, we've identified 3 warning signs for CR2 Empreendimentos Imobiliários (1 is potentially serious) that you should be aware of.

Of course CR2 Empreendimentos Imobiliários may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you decide to trade CR2 Empreendimentos Imobiliários, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:FIEI3

Fica Empreendimentos Imobiliarios

Develops, invests, constructs, and sells real estate properties in Brazil.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives