- Brazil

- /

- Real Estate

- /

- BOVESPA:MELK3

We Think Melnick Desenvolvimento Imobiliário (BVMF:MELK3) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Melnick Desenvolvimento Imobiliário S.A. (BVMF:MELK3) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does Melnick Desenvolvimento Imobiliário Carry?

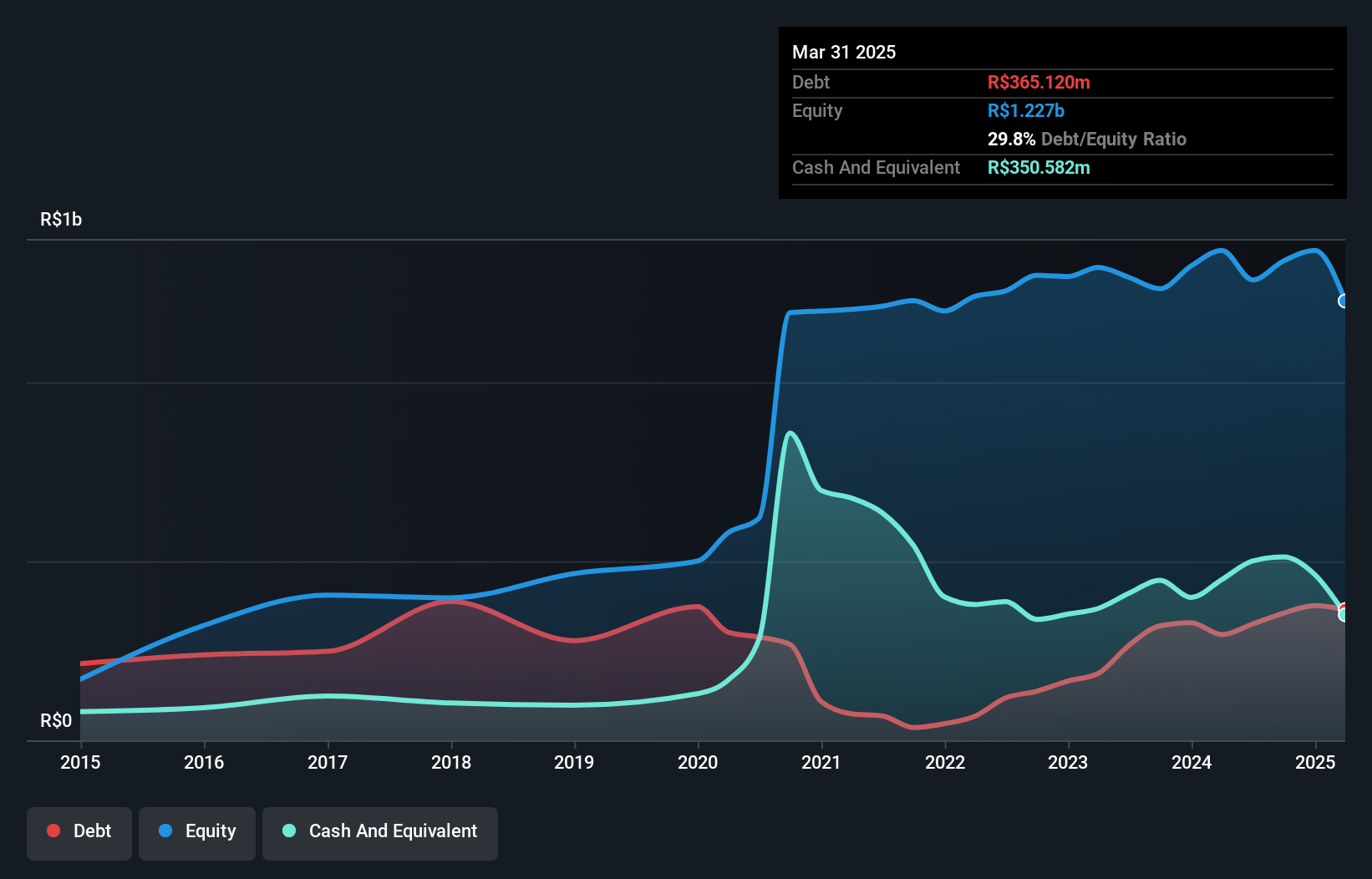

You can click the graphic below for the historical numbers, but it shows that as of March 2025 Melnick Desenvolvimento Imobiliário had R$365.1m of debt, an increase on R$295.3m, over one year. However, it also had R$350.6m in cash, and so its net debt is R$14.5m.

How Strong Is Melnick Desenvolvimento Imobiliário's Balance Sheet?

We can see from the most recent balance sheet that Melnick Desenvolvimento Imobiliário had liabilities of R$691.2m falling due within a year, and liabilities of R$570.9m due beyond that. Offsetting these obligations, it had cash of R$350.6m as well as receivables valued at R$794.9m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$116.7m.

Since publicly traded Melnick Desenvolvimento Imobiliário shares are worth a total of R$766.0m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

See our latest analysis for Melnick Desenvolvimento Imobiliário

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Melnick Desenvolvimento Imobiliário has a low debt to EBITDA ratio of only 0.26. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. The modesty of its debt load may become crucial for Melnick Desenvolvimento Imobiliário if management cannot prevent a repeat of the 50% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Melnick Desenvolvimento Imobiliário can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Melnick Desenvolvimento Imobiliário recorded free cash flow of 30% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Based on what we've seen Melnick Desenvolvimento Imobiliário is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. Looking at all this data makes us feel a little cautious about Melnick Desenvolvimento Imobiliário's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Melnick Desenvolvimento Imobiliário has 2 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MELK3

Melnick Desenvolvimento Imobiliário

Operates as a real estate development company in Brazil.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026