- Brazil

- /

- Entertainment

- /

- BOVESPA:SHOW3

Lacklustre Performance Is Driving T4F Entretenimento S.A.'s (BVMF:SHOW3) 32% Price Drop

T4F Entretenimento S.A. (BVMF:SHOW3) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

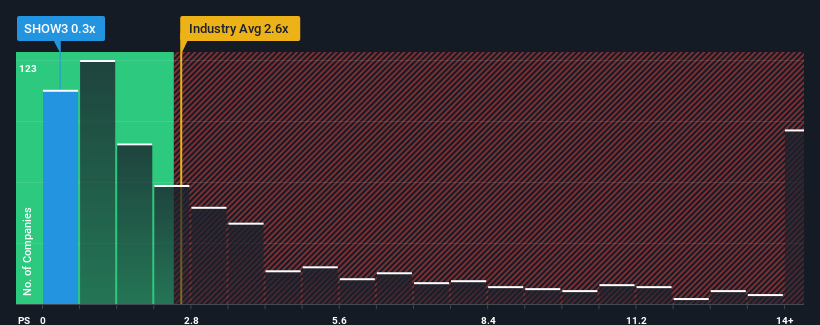

Since its price has dipped substantially, given about half the companies operating in Brazil's Entertainment industry have price-to-sales ratios (or "P/S") above 1.8x, you may consider T4F Entretenimento as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for T4F Entretenimento

How T4F Entretenimento Has Been Performing

With revenue growth that's exceedingly strong of late, T4F Entretenimento has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for T4F Entretenimento, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For T4F Entretenimento?

In order to justify its P/S ratio, T4F Entretenimento would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 17% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 13% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that T4F Entretenimento's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From T4F Entretenimento's P/S?

T4F Entretenimento's recently weak share price has pulled its P/S back below other Entertainment companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that T4F Entretenimento maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with T4F Entretenimento (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If you're unsure about the strength of T4F Entretenimento's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if T4F Entretenimento might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SHOW3

T4F Entretenimento

Operates as a live entertainment company in South America.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives