- Brazil

- /

- Interactive Media and Services

- /

- BOVESPA:ENJU3

Investors Holding Back On Enjoei S.A. (BVMF:ENJU3)

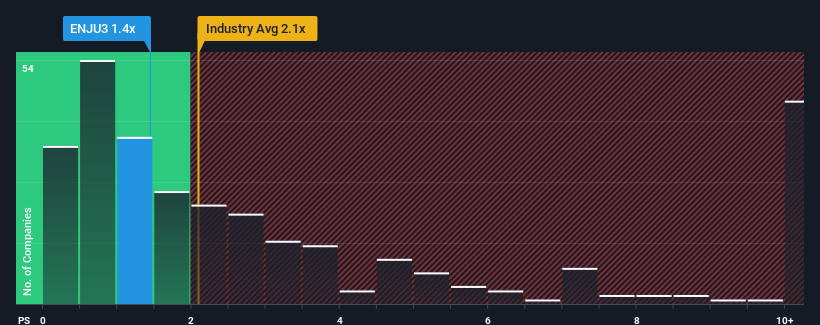

With a price-to-sales (or "P/S") ratio of 1.4x Enjoei S.A. (BVMF:ENJU3) may be sending bullish signals at the moment, given that almost half of all the Interactive Media and Services companies in Brazil have P/S ratios greater than 2.1x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Enjoei

What Does Enjoei's P/S Mean For Shareholders?

Enjoei certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Enjoei will help you uncover what's on the horizon.How Is Enjoei's Revenue Growth Trending?

In order to justify its P/S ratio, Enjoei would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The latest three year period has also seen an excellent 159% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 25% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 10% per annum, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Enjoei's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Enjoei's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Enjoei that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Enjoei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ENJU3

Enjoei

Operates a marketplace platform for the purchase and sale of used products in Brazil.

Flawless balance sheet and fair value.

Market Insights

Community Narratives