- Brazil

- /

- Interactive Media and Services

- /

- BOVESPA:CASH3

Méliuz (BVMF:CASH3) shareholders are still up 33% over 3 years despite pulling back 11% in the past week

It is a pleasure to report that the Méliuz S.A. (BVMF:CASH3) is up 89% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 44% in the last three years, falling well short of the market return.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Because Méliuz made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

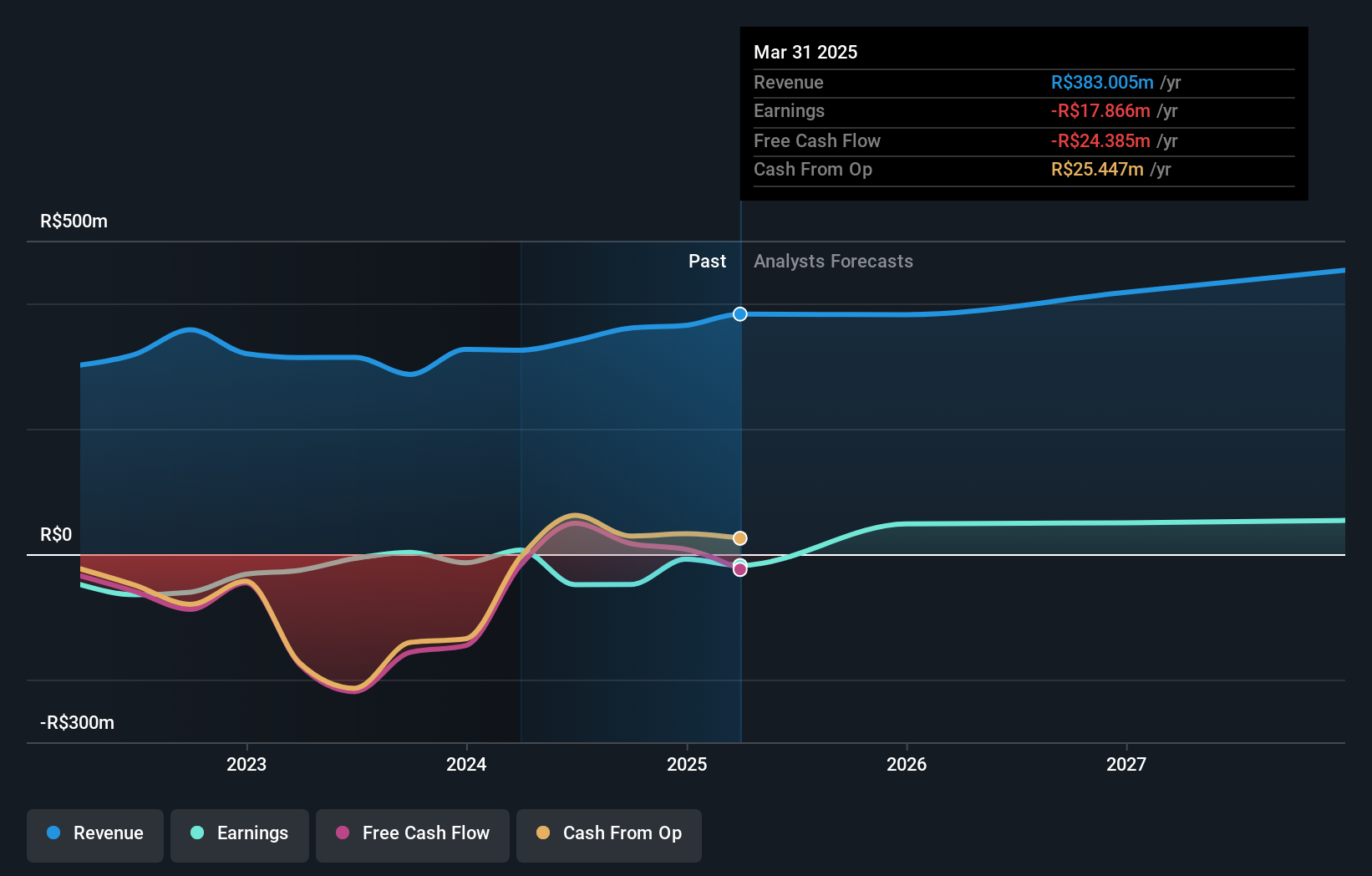

Over three years, Méliuz grew revenue at 5.5% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 13% during that time. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Méliuz's TSR for the last 3 years was 33%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Pleasingly, Méliuz's total shareholder return last year was 106%. That includes the value of the dividend. That's better than the annualized TSR of 10% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Méliuz (at least 2 which are concerning) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CASH3

Méliuz

Méliuz S.A., together with its subsidiaries, operate a virtual portal for the placement and dissemination of brands, products, services, and other advertising and publicity materials.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives