IRB-Brasil Resseguros (BVMF:IRBR3) Share Prices Have Dropped 80% In The Last Year

IRB-Brasil Resseguros S.A. (BVMF:IRBR3) shareholders should be happy to see the share price up 16% in the last quarter. But that doesn't change the fact that the returns over the last year have been stomach churning. To wit, the stock has dropped 80% over the last year. It's not uncommon to see a bounce after a drop like that. Only time will tell if the company can sustain the turnaround.

View our latest analysis for IRB-Brasil Resseguros

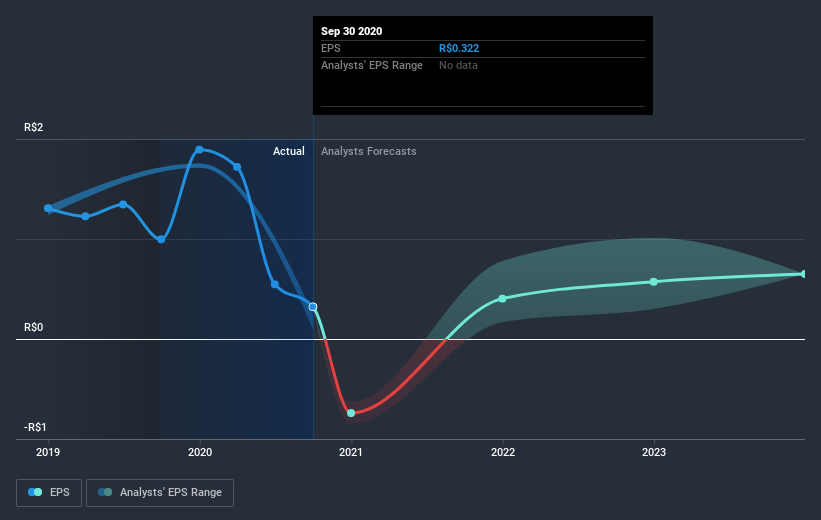

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unhappily, IRB-Brasil Resseguros had to report a 68% decline in EPS over the last year. We note that the 80% share price drop is very close to the EPS drop. So it seems that the market sentiment has not changed much, despite the weak results. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into IRB-Brasil Resseguros' key metrics by checking this interactive graph of IRB-Brasil Resseguros's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of IRB-Brasil Resseguros, it has a TSR of -77% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Over the last year, IRB-Brasil Resseguros shareholders took a loss of 77%, including dividends. In contrast the market gained about 5.8%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 6% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 5 warning signs for IRB-Brasil Resseguros you should be aware of, and 1 of them is significant.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you’re looking to trade IRB-Brasil Resseguros, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:IRBR3

IRB-Brasil Resseguros

Provides reinsurance solutions in Brazil and internationally.

Proven track record and fair value.

Market Insights

Community Narratives