- Brazil

- /

- Personal Products

- /

- BOVESPA:NATU3

Natura Cosméticos (BVMF:NATU3 investor five-year losses grow to 84% as the stock sheds R$412m this past week

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Anyone who held Natura Cosméticos S.A. (BVMF:NATU3) for five years would be nursing their metaphorical wounds since the share price dropped 85% in that time. And some of the more recent buyers are probably worried, too, with the stock falling 48% in the last year. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 3.9% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Natura Cosméticos wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Natura Cosméticos reduced its trailing twelve month revenue by 14% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 13% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

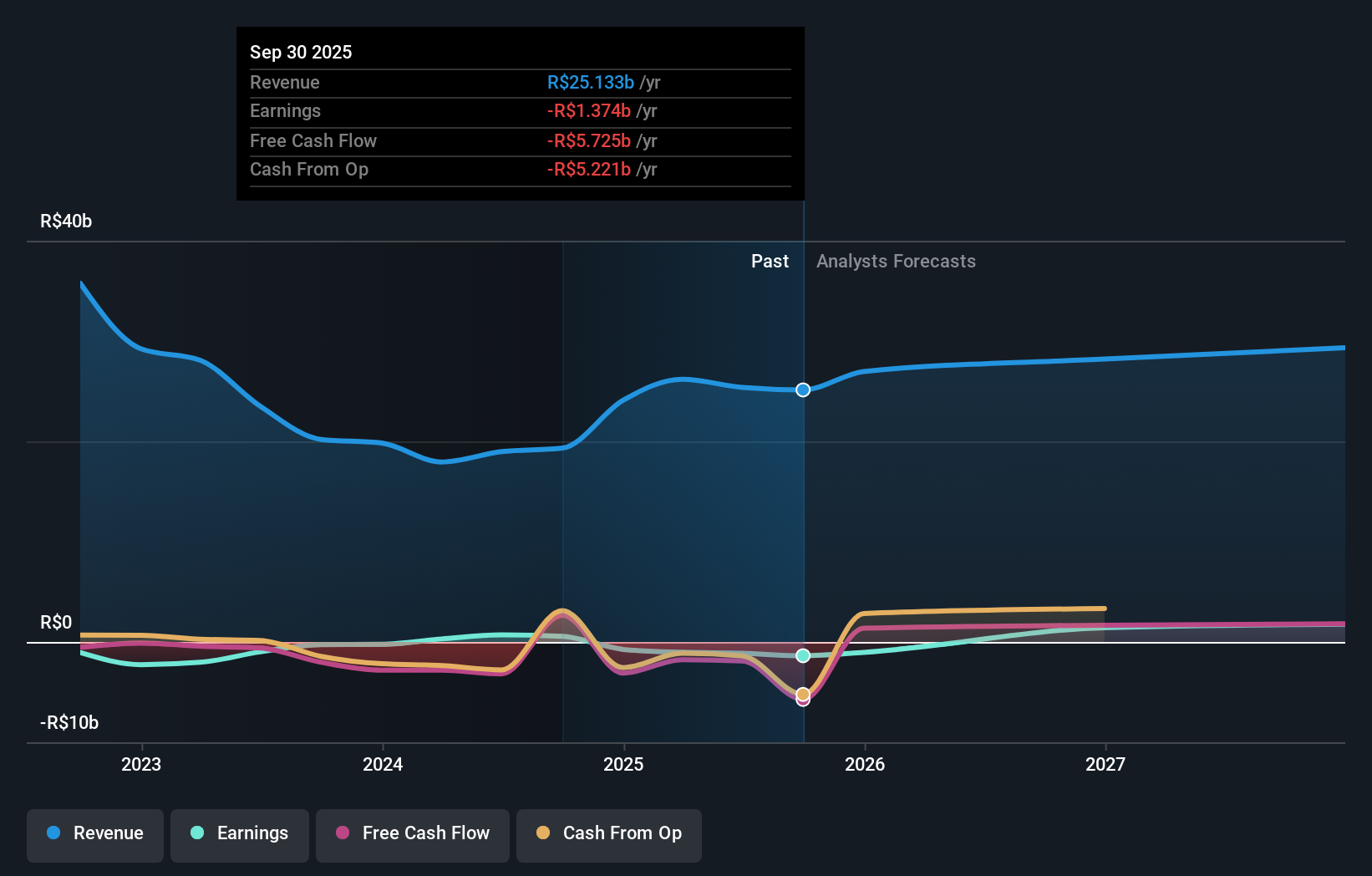

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Natura Cosméticos is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Natura Cosméticos in this interactive graph of future profit estimates.

A Different Perspective

Natura Cosméticos shareholders are down 48% for the year (even including dividends), but the market itself is up 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Natura Cosméticos (including 1 which is a bit concerning) .

We will like Natura Cosméticos better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Natura Cosméticos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:NATU3

Natura Cosméticos

Engages in the development, manufacture, distribution, and marketing of cosmetics, fragrances, and personal hygiene products in Brazil, Peru, Colombia, Chile, Argentina, Uruguay, and Ecuador.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success