- Brazil

- /

- Healthcare Services

- /

- BOVESPA:HAPV3

Hapvida Participações e Investimentos S.A.'s (BVMF:HAPV3) Share Price Is Still Matching Investor Opinion Despite 43% Slump

The Hapvida Participações e Investimentos S.A. (BVMF:HAPV3) share price has fared very poorly over the last month, falling by a substantial 43%. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

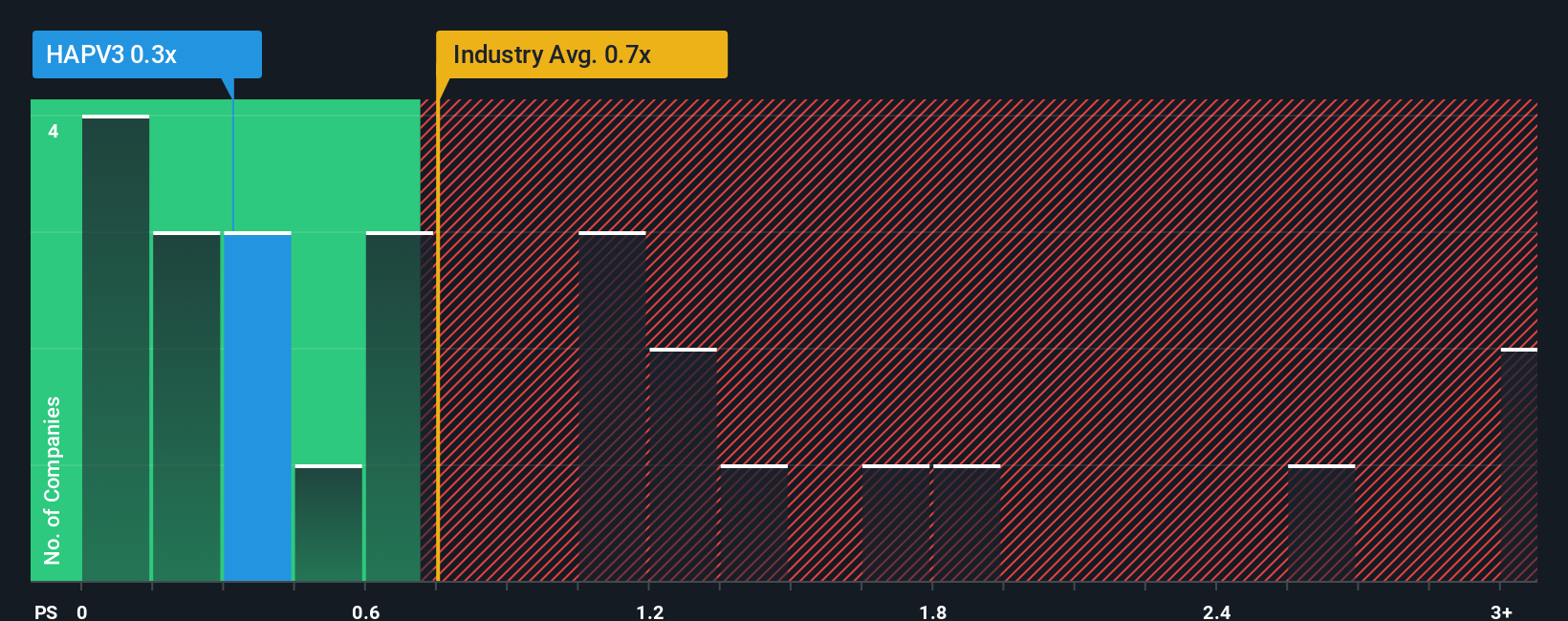

Although its price has dipped substantially, there still wouldn't be many who think Hapvida Participações e Investimentos' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Brazil's Healthcare industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Hapvida Participações e Investimentos

How Hapvida Participações e Investimentos Has Been Performing

Recent revenue growth for Hapvida Participações e Investimentos has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hapvida Participações e Investimentos.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Hapvida Participações e Investimentos would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 83% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 8.6% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 11% per annum, which is not materially different.

In light of this, it's understandable that Hapvida Participações e Investimentos' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Hapvida Participações e Investimentos' P/S

Hapvida Participações e Investimentos' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Hapvida Participações e Investimentos' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Healthcare industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Hapvida Participações e Investimentos, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Hapvida Participações e Investimentos, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hapvida Participações e Investimentos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:HAPV3

Hapvida Participações e Investimentos

Operates in the healthcare sector in Brazil.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives