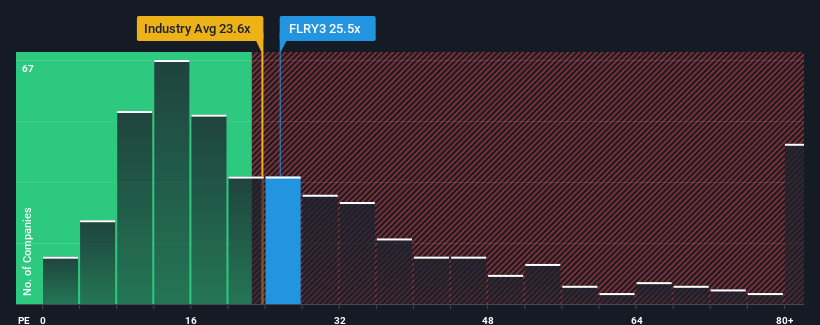

Fleury S.A.'s (BVMF:FLRY3) price-to-earnings (or "P/E") ratio of 25.5x might make it look like a strong sell right now compared to the market in Brazil, where around half of the companies have P/E ratios below 11x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Fleury hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Fleury

Is There Enough Growth For Fleury?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Fleury's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. Still, the latest three year period has seen an excellent 31% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 50% as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 22%, which is noticeably less attractive.

With this information, we can see why Fleury is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Fleury's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Fleury has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Fleury's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:FLRY3

Fleury

Provides diagnostic imaging, clinical analysis, fertility, and infusions services in Brazil.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives