- Brazil

- /

- Healthcare Services

- /

- BOVESPA:DASA3

Why Investors Shouldn't Be Surprised By Diagnósticos da América S.A.'s (BVMF:DASA3) 25% Share Price Plunge

Unfortunately for some shareholders, the Diagnósticos da América S.A. (BVMF:DASA3) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

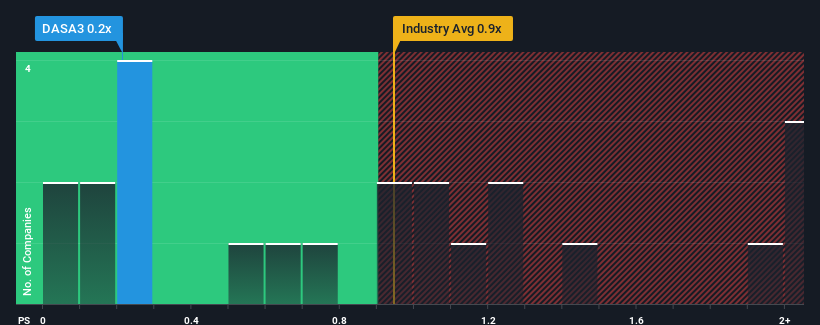

Following the heavy fall in price, considering around half the companies operating in Brazil's Healthcare industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider Diagnósticos da América as an solid investment opportunity with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Diagnósticos da América

What Does Diagnósticos da América's Recent Performance Look Like?

Recent times haven't been great for Diagnósticos da América as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Diagnósticos da América's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Diagnósticos da América's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.6%. This was backed up an excellent period prior to see revenue up by 102% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 7.1% per annum during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 10% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Diagnósticos da América's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The southerly movements of Diagnósticos da América's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Diagnósticos da América's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Diagnósticos da América that you need to take into consideration.

If you're unsure about the strength of Diagnósticos da América's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:DASA3

Diagnósticos da América

Provides diagnostic and hospital services in Brazil and Argentina.

Fair value with moderate growth potential.

Market Insights

Community Narratives