- Brazil

- /

- Healthcare Services

- /

- BOVESPA:AALR3

Optimistic Investors Push Alliança Saúde e Participações S.A. (BVMF:AALR3) Shares Up 60% But Growth Is Lacking

Alliança Saúde e Participações S.A. (BVMF:AALR3) shareholders have had their patience rewarded with a 60% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

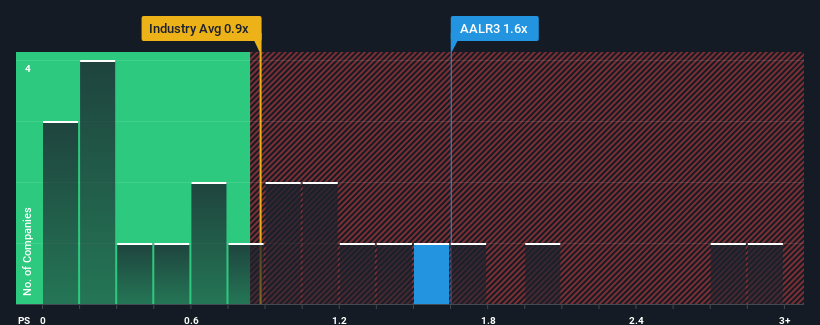

After such a large jump in price, you could be forgiven for thinking Alliança Saúde e Participações is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Brazil's Healthcare industry have P/S ratios below 0.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Alliança Saúde e Participações

What Does Alliança Saúde e Participações' Recent Performance Look Like?

Alliança Saúde e Participações has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Alliança Saúde e Participações, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Alliança Saúde e Participações' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 6.5% gain to the company's revenues. The latest three year period has also seen a 20% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 11% shows it's noticeably less attractive.

With this information, we find it concerning that Alliança Saúde e Participações is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Alliança Saúde e Participações' P/S

Alliança Saúde e Participações shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Alliança Saúde e Participações revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Alliança Saúde e Participações (of which 1 is a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on Alliança Saúde e Participações, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:AALR3

Alliança Saúde e Participações

Provides diagnostic medicine services in Brazil.

Mediocre balance sheet very low.

Market Insights

Community Narratives