Optimistic Investors Push Marfrig Global Foods S.A. (BVMF:MBRF3) Shares Up 31% But Growth Is Lacking

Marfrig Global Foods S.A. (BVMF:MBRF3) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

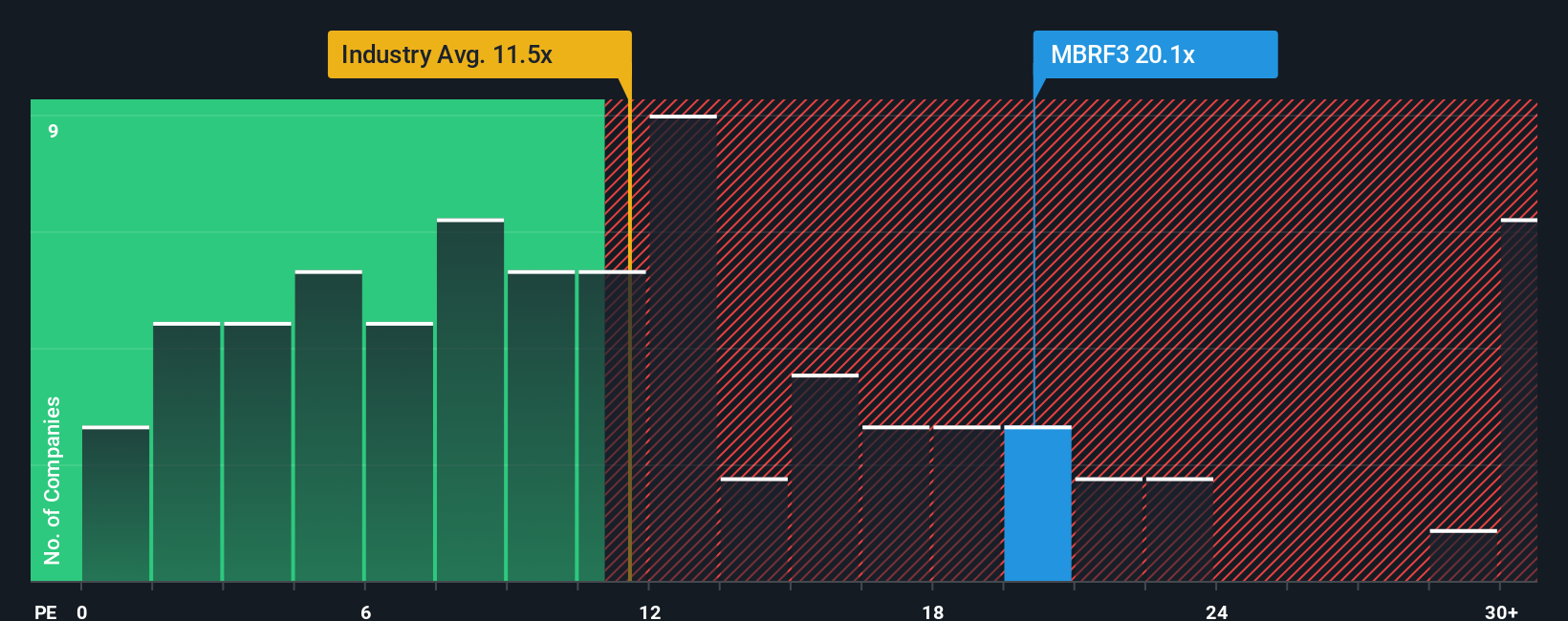

After such a large jump in price, Marfrig Global Foods' price-to-earnings (or "P/E") ratio of 20.1x might make it look like a strong sell right now compared to the market in Brazil, where around half of the companies have P/E ratios below 9x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Marfrig Global Foods as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Marfrig Global Foods

Is There Enough Growth For Marfrig Global Foods?

In order to justify its P/E ratio, Marfrig Global Foods would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 234% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 89% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 70% during the coming year according to the ten analysts following the company. With the market predicted to deliver 16% growth , that's a disappointing outcome.

In light of this, it's alarming that Marfrig Global Foods' P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

Shares in Marfrig Global Foods have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Marfrig Global Foods currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for Marfrig Global Foods (3 are a bit concerning!) that you should be aware of.

Of course, you might also be able to find a better stock than Marfrig Global Foods. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MBRF3

Marfrig Global Foods

Through its subsidiaries, operates in the food industry in Brazil and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives