- Brazil

- /

- Consumer Services

- /

- BOVESPA:SEER3

Revenues Tell The Story For Ser Educacional S.A. (BVMF:SEER3) As Its Stock Soars 28%

Ser Educacional S.A. (BVMF:SEER3) shareholders have had their patience rewarded with a 28% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 4.3% isn't as attractive.

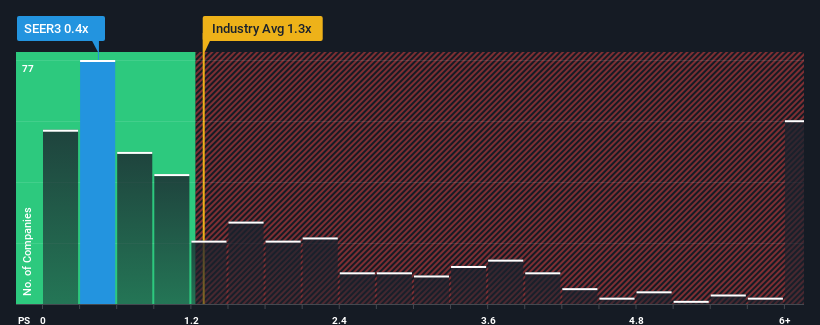

Even after such a large jump in price, it's still not a stretch to say that Ser Educacional's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Consumer Services industry in Brazil, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Ser Educacional

How Has Ser Educacional Performed Recently?

Ser Educacional could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ser Educacional.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Ser Educacional would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.9% gain to the company's revenues. The latest three year period has also seen an excellent 46% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 6.5% per annum as estimated by the six analysts watching the company. That's shaping up to be similar to the 6.9% each year growth forecast for the broader industry.

In light of this, it's understandable that Ser Educacional's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Ser Educacional's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Ser Educacional maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Ser Educacional (1 is significant) you should be aware of.

If you're unsure about the strength of Ser Educacional's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SEER3

Ser Educacional

Operates on-campus and distance-learning undergraduate, graduate, and professional training courses and other education-related areas in Brazil.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success