- Brazil

- /

- Hospitality

- /

- BOVESPA:ZAMP3

BK Brasil Operação e Assessoria a Restaurantes (BVMF:BKBR3) Share Prices Have Dropped 41% In The Last Year

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the BK Brasil Operação e Assessoria a Restaurantes S.A. (BVMF:BKBR3) share price is down 41% in the last year. That contrasts poorly with the market return of 3.7%. We wouldn't rush to judgement on BK Brasil Operação e Assessoria a Restaurantes because we don't have a long term history to look at. The silver lining is that the stock is up 3.6% in about a week.

View our latest analysis for BK Brasil Operação e Assessoria a Restaurantes

Because BK Brasil Operação e Assessoria a Restaurantes made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year BK Brasil Operação e Assessoria a Restaurantes saw its revenue fall by 7.6%. That's not what investors generally want to see. The stock price has languished lately, falling 41% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

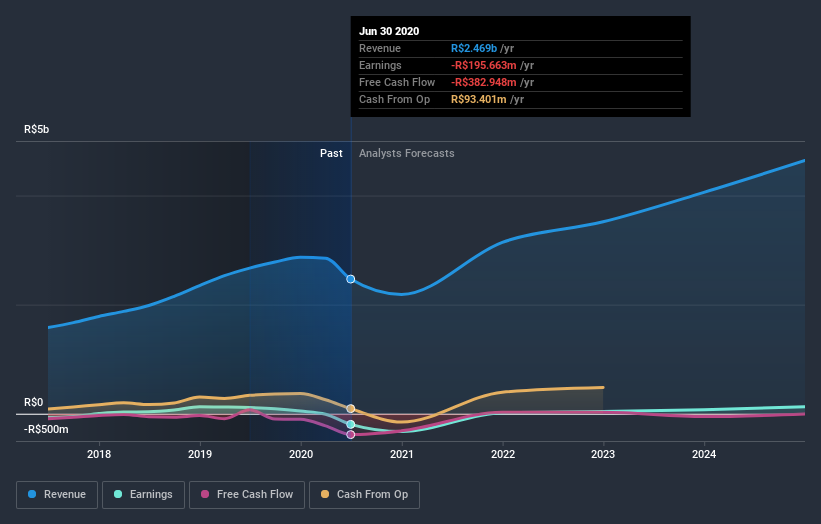

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

BK Brasil Operação e Assessoria a Restaurantes is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for BK Brasil Operação e Assessoria a Restaurantes in this interactive graph of future profit estimates.

A Different Perspective

While BK Brasil Operação e Assessoria a Restaurantes shareholders are down 41% for the year, the market itself is up 3.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 8.6% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that BK Brasil Operação e Assessoria a Restaurantes is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you decide to trade BK Brasil Operação e Assessoria a Restaurantes, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zamp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:ZAMP3

Zamp

Engages in the developing, operating, and franchising restaurants under the Burger King, Popeyes, Starbucks, and Subway brand names in Brazil.

Reasonable growth potential and fair value.

Market Insights

Community Narratives