Market Participants Recognise Veste S.A. Estilo's (BVMF:VSTE3) Revenues Pushing Shares 28% Higher

Veste S.A. Estilo (BVMF:VSTE3) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

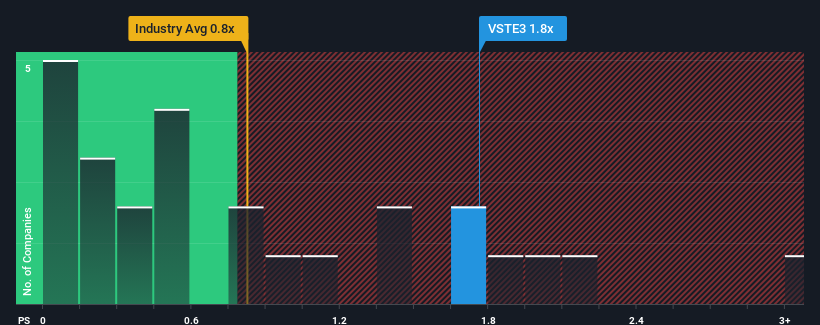

Following the firm bounce in price, when almost half of the companies in Brazil's Luxury industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Veste Estilo as a stock probably not worth researching with its 1.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Veste Estilo

How Veste Estilo Has Been Performing

While the industry has experienced revenue growth lately, Veste Estilo's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Veste Estilo's future stacks up against the industry? In that case, our free report is a great place to start.How Is Veste Estilo's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Veste Estilo's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 96% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 25% over the next year. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

In light of this, it's understandable that Veste Estilo's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Veste Estilo's P/S

The large bounce in Veste Estilo's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Veste Estilo's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Veste Estilo that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:VSTE3

Veste Estilo

Veste S.A. Estilo manufacture and sells clothing and clothing accessories in Brazil.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives