- Brazil

- /

- Consumer Durables

- /

- BOVESPA:TEND3

The Returns On Capital At Construtora Tenda (BVMF:TEND3) Don't Inspire Confidence

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. In light of that, when we looked at Construtora Tenda (BVMF:TEND3) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Construtora Tenda is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.063 = R$194m ÷ (R$4.7b - R$1.6b) (Based on the trailing twelve months to June 2024).

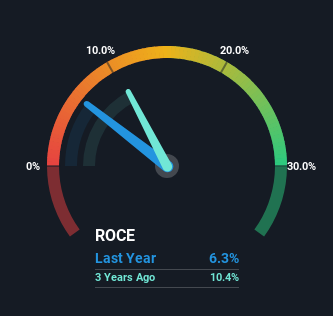

So, Construtora Tenda has an ROCE of 6.3%. In absolute terms, that's a low return but it's around the Consumer Durables industry average of 6.5%.

See our latest analysis for Construtora Tenda

Above you can see how the current ROCE for Construtora Tenda compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Construtora Tenda for free.

How Are Returns Trending?

In terms of Construtora Tenda's historical ROCE movements, the trend isn't fantastic. Around five years ago the returns on capital were 13%, but since then they've fallen to 6.3%. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. If these investments prove successful, this can bode very well for long term stock performance.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 34%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. While the ratio isn't currently too high, it's worth keeping an eye on this because if it gets particularly high, the business could then face some new elements of risk.

The Bottom Line

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Construtora Tenda. And there could be an opportunity here if other metrics look good too, because the stock has declined 42% in the last five years. As a result, we'd recommend researching this stock further to uncover what other fundamentals of the business can show us.

Construtora Tenda does have some risks though, and we've spotted 1 warning sign for Construtora Tenda that you might be interested in.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:TEND3

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success