- Brazil

- /

- Consumer Durables

- /

- BOVESPA:PLPL3

Plano & Plano Desenvolvimento Imobiliário S.A.'s (BVMF:PLPL3) Shares Not Telling The Full Story

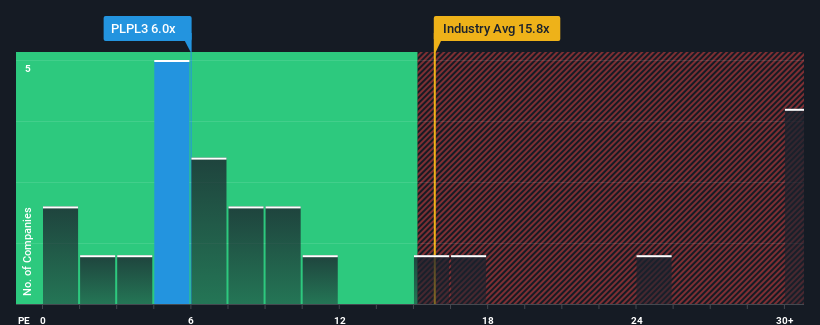

When close to half the companies in Brazil have price-to-earnings ratios (or "P/E's") above 9x, you may consider Plano & Plano Desenvolvimento Imobiliário S.A. (BVMF:PLPL3) as an attractive investment with its 6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Plano & Plano Desenvolvimento Imobiliário has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Plano & Plano Desenvolvimento Imobiliário

Does Growth Match The Low P/E?

Plano & Plano Desenvolvimento Imobiliário's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 39% last year. Pleasingly, EPS has also lifted 122% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 36% as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 17% growth forecast for the broader market.

In light of this, it's peculiar that Plano & Plano Desenvolvimento Imobiliário's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Plano & Plano Desenvolvimento Imobiliário's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Plano & Plano Desenvolvimento Imobiliário's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Plano & Plano Desenvolvimento Imobiliário with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Plano & Plano Desenvolvimento Imobiliário. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PLPL3

Plano & Plano Desenvolvimento Imobiliário

Through its subsidiaries develops, constructs, and sells real estate projects in the São Paulo Metropolitan Region.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026