- Brazil

- /

- Consumer Durables

- /

- BOVESPA:PLPL3

Can Plano & Plano Desenvolvimento Imobiliário S.A. (BVMF:PLPL3) Maintain Its Strong Returns?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). To keep the lesson grounded in practicality, we'll use ROE to better understand Plano & Plano Desenvolvimento Imobiliário S.A. (BVMF:PLPL3).

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Plano & Plano Desenvolvimento Imobiliário

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Plano & Plano Desenvolvimento Imobiliário is:

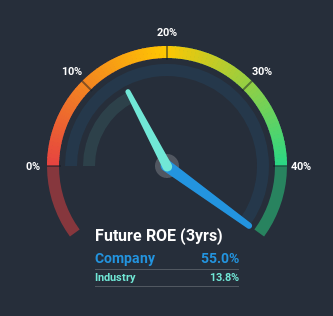

55% = R$118m ÷ R$214m (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every R$1 of its shareholder's investments, the company generates a profit of R$0.55.

Does Plano & Plano Desenvolvimento Imobiliário Have A Good ROE?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As you can see in the graphic below, Plano & Plano Desenvolvimento Imobiliário has a higher ROE than the average (14%) in the Consumer Durables industry.

That is a good sign. However, bear in mind that a high ROE doesn’t necessarily indicate efficient profit generation. Aside from changes in net income, a high ROE can also be the outcome of high debt relative to equity, which indicates risk. Our risks dashboardshould have the 3 risks we have identified for Plano & Plano Desenvolvimento Imobiliário.

The Importance Of Debt To Return On Equity

Companies usually need to invest money to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Plano & Plano Desenvolvimento Imobiliário's Debt And Its 55% ROE

Plano & Plano Desenvolvimento Imobiliário clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.75. While no doubt that its ROE is impressive, we would have been even more impressed had the company achieved this with lower debt. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Conclusion

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. A company that can achieve a high return on equity without debt could be considered a high quality business. All else being equal, a higher ROE is better.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So I think it may be worth checking this free report on analyst forecasts for the company.

Of course Plano & Plano Desenvolvimento Imobiliário may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

If you decide to trade Plano & Plano Desenvolvimento Imobiliário, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:PLPL3

Plano & Plano Desenvolvimento Imobiliário

Through its subsidiaries develops, constructs, and sells real estate projects in the São Paulo Metropolitan Region.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success