- Brazil

- /

- Consumer Durables

- /

- BOVESPA:AVLL3

Alphaville S.A.'s (BVMF:AVLL3) P/S Is Still On The Mark Following 25% Share Price Bounce

Alphaville S.A. (BVMF:AVLL3) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

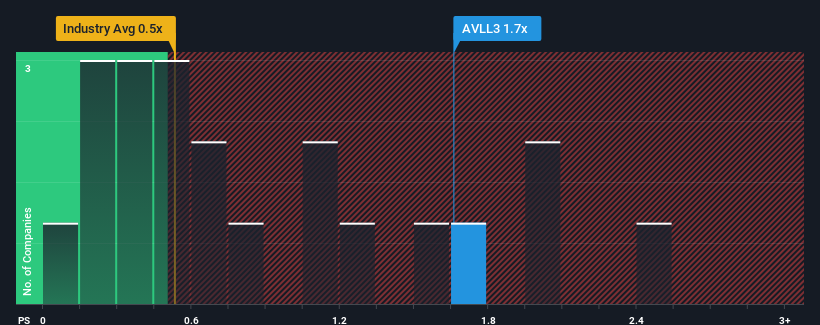

Since its price has surged higher, when almost half of the companies in Brazil's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Alphaville as a stock probably not worth researching with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Alphaville

How Has Alphaville Performed Recently?

Alphaville certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Alphaville's future stacks up against the industry? In that case, our free report is a great place to start.How Is Alphaville's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Alphaville's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. The latest three year period has also seen an excellent 87% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 69% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

With this information, we can see why Alphaville is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Alphaville's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Alphaville maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Durables industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 2 warning signs for Alphaville that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AVLL3

Alphaville

Engages in residential subdivision business under the Alphaville brand in Brazil.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives