Could Arezzo Indústria e Comércio S.A.'s (BVMF:ARZZ3) Weak Financials Mean That The Market Could Correct Its Share Price?

Most readers would already know that Arezzo Indústria e Comércio's (BVMF:ARZZ3) stock increased by 3.2% over the past three months. However, its weak financial performance indicators makes us a bit doubtful if that trend could continue. Specifically, we decided to study Arezzo Indústria e Comércio's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Arezzo Indústria e Comércio

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Arezzo Indústria e Comércio is:

3.6% = R$49m ÷ R$1.3b (Based on the trailing twelve months to December 2020).

The 'return' is the yearly profit. One way to conceptualize this is that for each R$1 of shareholders' capital it has, the company made R$0.04 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Arezzo Indústria e Comércio's Earnings Growth And 3.6% ROE

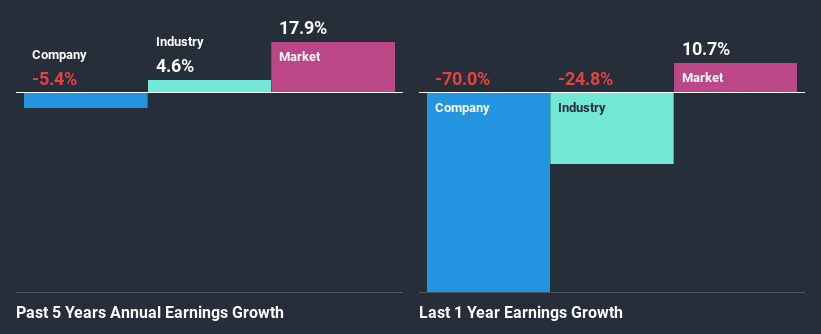

As you can see, Arezzo Indústria e Comércio's ROE looks pretty weak. Even when compared to the industry average of 7.6%, the ROE figure is pretty disappointing. For this reason, Arezzo Indústria e Comércio's five year net income decline of 5.4% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared Arezzo Indústria e Comércio's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 4.6% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Arezzo Indústria e Comércio's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Arezzo Indústria e Comércio Making Efficient Use Of Its Profits?

With a three-year median payout ratio as high as 108%,Arezzo Indústria e Comércio's shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Paying a dividend beyond their means is usually not viable over the long term. Our risks dashboard should have the 4 risks we have identified for Arezzo Indústria e Comércio.

In addition, Arezzo Indústria e Comércio has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 38% over the next three years. Accordingly, the expected drop in the payout ratio explains the expected increase in the company's ROE to 32%, over the same period.

Summary

In total, we would have a hard think before deciding on any investment action concerning Arezzo Indústria e Comércio. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade Arezzo Indústria e Comércio, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:AZZA3

Azzas 2154

Engages in the development and marketing of women's, men's and children's footwear, handbags, accessories, and clothing in Brazil and internationally.

Very undervalued with adequate balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026