Has Kepler Weber S.A.'s (BVMF:KEPL3) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Most readers would already be aware that Kepler Weber's (BVMF:KEPL3) stock increased significantly by 50% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Particularly, we will be paying attention to Kepler Weber's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Kepler Weber

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kepler Weber is:

13% = R$91m ÷ R$687m (Based on the trailing twelve months to September 2021).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each R$1 of shareholders' capital it has, the company made R$0.13 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Kepler Weber's Earnings Growth And 13% ROE

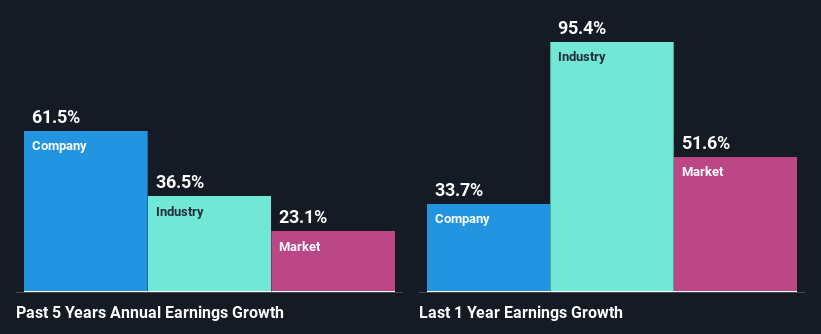

On the face of it, Kepler Weber's ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 19% either. In spite of this, Kepler Weber was able to grow its net income considerably, at a rate of 61% in the last five years. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that Kepler Weber's growth is quite high when compared to the industry average growth of 36% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Kepler Weber's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Kepler Weber Using Its Retained Earnings Effectively?

Kepler Weber has a three-year median payout ratio of 38% (where it is retaining 62% of its income) which is not too low or not too high. By the looks of it, the dividend is well covered and Kepler Weber is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Besides, Kepler Weber has been paying dividends over a period of nine years. This shows that the company is committed to sharing profits with its shareholders.

Summary

Overall, we feel that Kepler Weber certainly does have some positive factors to consider. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 3 risks we have identified for Kepler Weber.

Valuation is complex, but we're here to simplify it.

Discover if Kepler Weber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:KEPL3

Kepler Weber

Provides grain storage equipment and post-harvest grain solutions in Brazil, the Americas, Africa, Europe, and Asia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026