Stock Analysis

Market is not liking AgroGalaxy Participações' (BVMF:AGXY3) earnings decline as stock retreats 11% this week

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in AgroGalaxy Participações S.A. (BVMF:AGXY3) have tasted that bitter downside in the last year, as the share price dropped 37%. That contrasts poorly with the market return of 11%. Because AgroGalaxy Participações hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 27% in the last 90 days.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for AgroGalaxy Participações

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

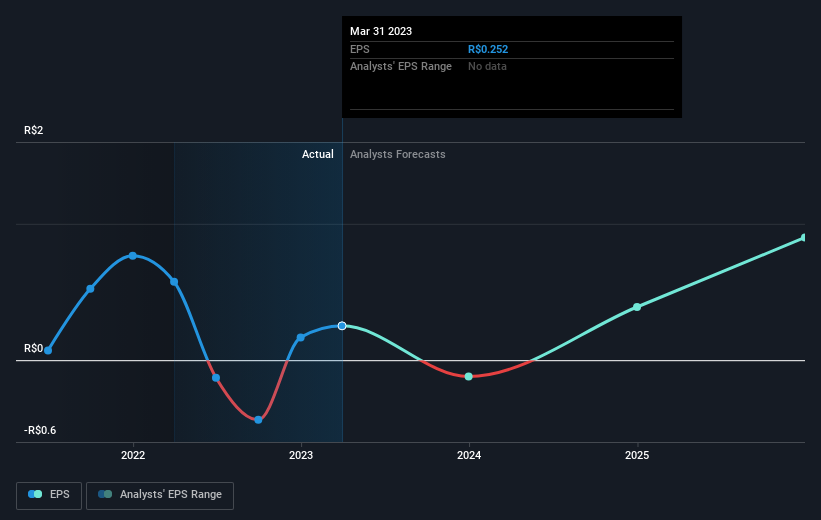

During the last year AgroGalaxy Participações grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on AgroGalaxy Participações' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While AgroGalaxy Participações shareholders are down 37% for the year (even including dividends), the market itself is up 11%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 27%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for AgroGalaxy Participações (of which 1 shouldn't be ignored!) you should know about.

Of course AgroGalaxy Participações may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AGXY3

Reasonable growth potential and fair value.