- Brazil

- /

- Transportation

- /

- BOVESPA:RENT3

Three Growth Companies With High Insider Ownership And 27% Earnings Growth

Reviewed by Simply Wall St

Amidst a backdrop of mixed global market performances and economic indicators, investors continue to navigate through fluctuations in major indices and sectors. In such a landscape, growth companies with high insider ownership can be particularly compelling, as they often signal confidence from those who know the business best—its leaders and founders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Medley (TSE:4480) | 34% | 28.7% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.8% | 58.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

Here we highlight a subset of our preferred stocks from the screener.

Localiza Rent a Car (BOVESPA:RENT3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Localiza Rent a Car S.A. operates in the car and fleet rental sector both within Brazil and globally, with a market capitalization of approximately R$46.63 billion.

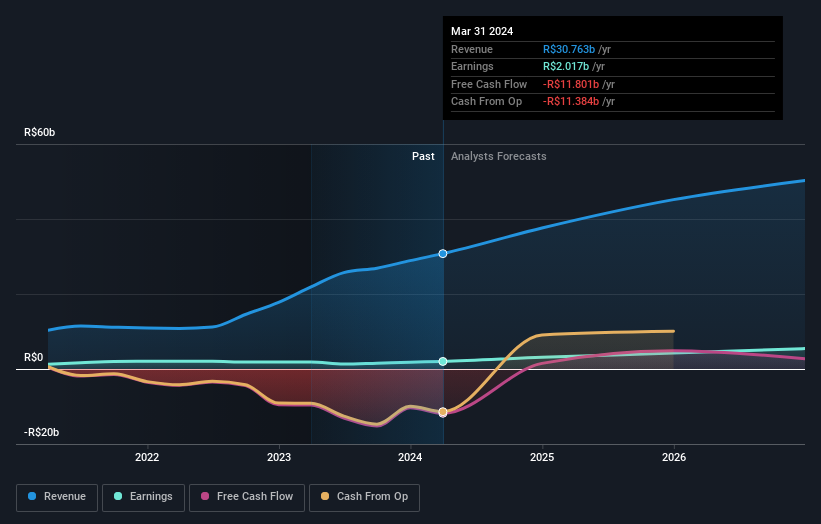

Operations: The company generates its revenue primarily from the car and fleet rental sector, totaling approximately R$30.75 billion.

Insider Ownership: 19.1%

Earnings Growth Forecast: 28.2% p.a.

Localiza Rent a Car, despite experiencing shareholder dilution over the past year, is poised for significant growth with earnings expected to increase by 28.16% annually. This growth surpasses the broader Brazilian market's average. However, its dividend sustainability is questionable as it is not well-covered by free cash flows. Additionally, while revenue growth projections of 15.9% annually outpace market averages, they fall short of more aggressive benchmarks. Recent financial results show a robust increase in sales and net income compared to the previous year, underscoring its potential amid financial challenges.

- Dive into the specifics of Localiza Rent a Car here with our thorough growth forecast report.

- According our valuation report, there's an indication that Localiza Rent a Car's share price might be on the expensive side.

Suning.com (SZSE:002024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suning.com Co., Ltd. operates a retail business in China, with a market capitalization of approximately CN¥11.27 billion.

Operations: The company operates in the retail sector across China, with a market capitalization of approximately CN¥11.27 billion.

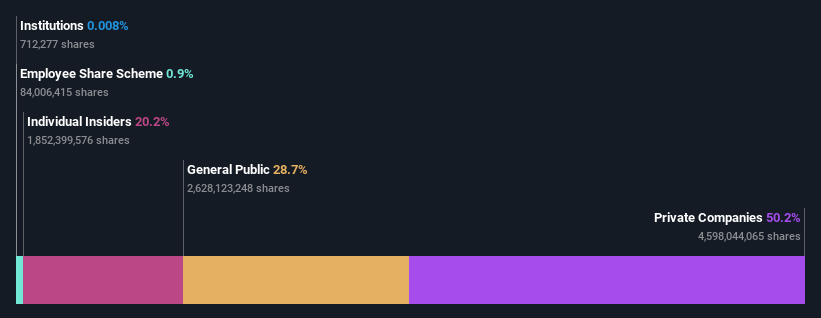

Insider Ownership: 20.2%

Earnings Growth Forecast: 105.4% p.a.

Suning.com is anticipated to shift into profitability within the next three years, outpacing average market growth. Despite a recent net loss of CNY 96.87 million in Q1 2024, the company's earnings are expected to surge by 105.42% annually. Additionally, Suning.com's revenue growth forecast at 15% per year exceeds China's market average of 13.6%. A recent buyback initiative underscores a commitment to shareholder value, enhancing insider ownership dynamics despite trading at a significant discount compared to its estimated fair value.

- Unlock comprehensive insights into our analysis of Suning.com stock in this growth report.

- Our valuation report here indicates Suning.com may be undervalued.

Shin Zu Shing (TWSE:3376)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shin Zu Shing Co., Ltd. is a company based in Taiwan that specializes in the design and manufacture of precision springs, stamping parts, and other related components, with operations extending to Singapore and China. The company has a market capitalization of approximately NT$43.28 billion.

Operations: Shin Zu Shing generates revenue primarily from pivot products, which contributed NT$10.50 billion, with additional income from MIM products and milled car parts products totaling NT$385.78 million and NT$102.56 million, respectively.

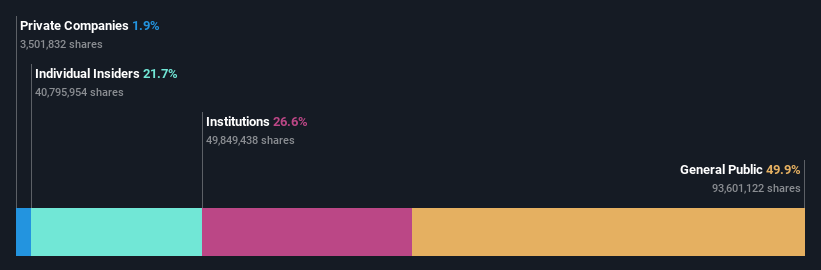

Insider Ownership: 23.1%

Earnings Growth Forecast: 27% p.a.

Shin Zu Shing is poised for robust growth with earnings expected to rise by 27% annually, outstripping the TW market's 18.8%. However, its profit margins have dipped from 13.6% to 9%, reflecting some operational challenges. Recent strategic moves include a private placement aimed at raising TWD 80 million and a dividend cut, signaling potential reinvestment in growth avenues. Despite these promising aspects, the company's share price has been highly volatile recently.

- Delve into the full analysis future growth report here for a deeper understanding of Shin Zu Shing.

- Insights from our recent valuation report point to the potential overvaluation of Shin Zu Shing shares in the market.

Key Takeaways

- Explore the 1461 names from our Fast Growing Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:RENT3

Localiza Rent a Car

Engages in car and fleet rental business in Brazil and internationally.

Reasonable growth potential average dividend payer.