- Bulgaria

- /

- Electric Utilities

- /

- BUL:TPLB

A Piece Of The Puzzle Missing From Toplofikatsia-Burgas AD's (BUL:TPLB) 26% Share Price Climb

Toplofikatsia-Burgas AD (BUL:TPLB) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

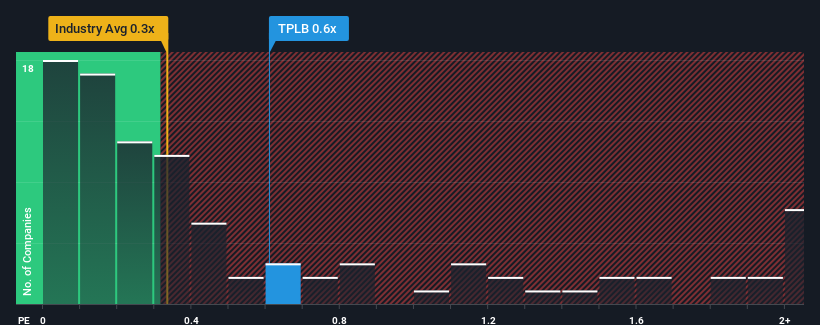

Although its price has surged higher, there still wouldn't be many who think Toplofikatsia-Burgas AD's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when it essentially matches the median P/S in Bulgaria's Electric Utilities industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Toplofikatsia-Burgas AD

What Does Toplofikatsia-Burgas AD's P/S Mean For Shareholders?

Recent times have been quite advantageous for Toplofikatsia-Burgas AD as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Toplofikatsia-Burgas AD's earnings, revenue and cash flow.How Is Toplofikatsia-Burgas AD's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Toplofikatsia-Burgas AD's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 92% last year. The latest three year period has also seen an excellent 261% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 9.0% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that Toplofikatsia-Burgas AD's P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Toplofikatsia-Burgas AD's P/S?

Toplofikatsia-Burgas AD appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Toplofikatsia-Burgas AD revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Toplofikatsia-Burgas AD (2 shouldn't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Toplofikatsia-Burgas AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:TPLB

Toplofikatsia-Burgas AD

Engages in the production, transmission, and sale of electricity in Bulgaria.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives