Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Trace Group Hold (BUL:T57). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Trace Group Hold's Improving Profits

In the last three years Trace Group Hold's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Trace Group Hold's EPS soared from лв0.84 to лв1.32, over the last year. That's a impressive gain of 58%.

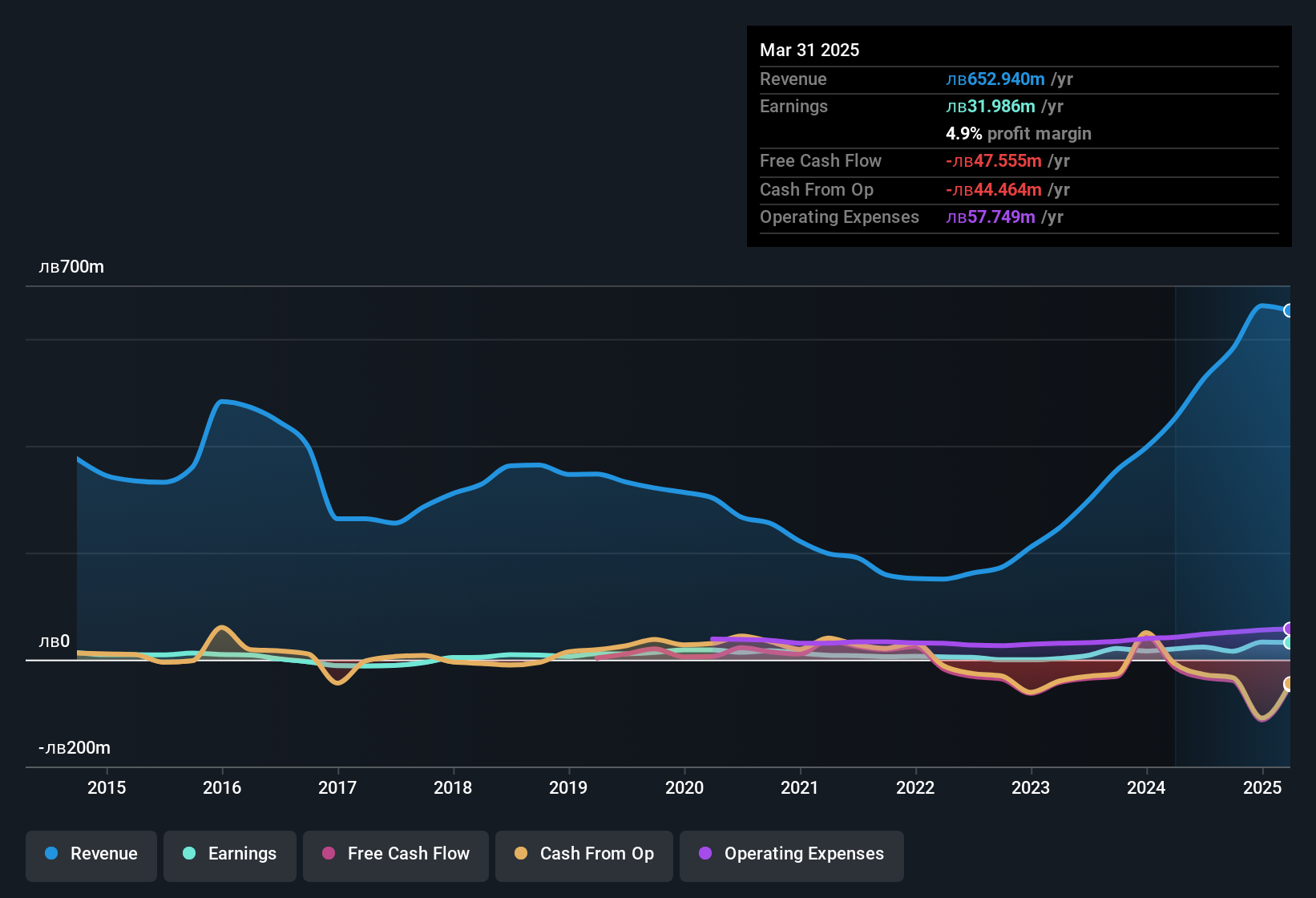

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Trace Group Hold is growing revenues, and EBIT margins improved by 2.2 percentage points to 7.7%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

See our latest analysis for Trace Group Hold

Since Trace Group Hold is no giant, with a market capitalisation of лв148m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Trace Group Hold Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Trace Group Hold insiders own a meaningful share of the business. In fact, they own 72% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have лв107m invested in the business, at the current share price. That's nothing to sneeze at!

Is Trace Group Hold Worth Keeping An Eye On?

You can't deny that Trace Group Hold has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Trace Group Hold's continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Before you take the next step you should know about the 5 warning signs for Trace Group Hold (2 are significant!) that we have uncovered.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in BG with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

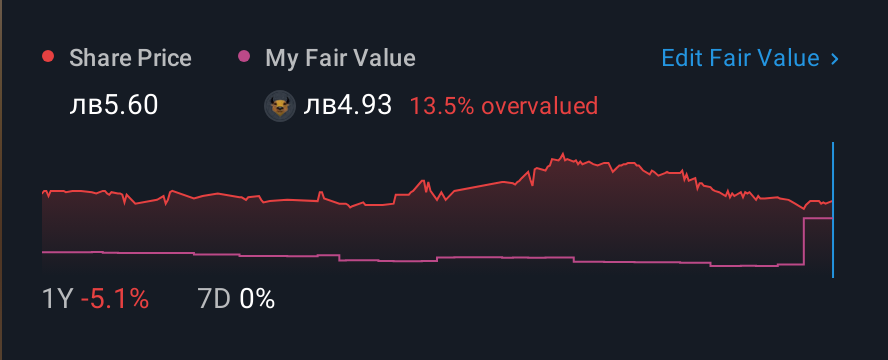

Valuation is complex, but we're here to simplify it.

Discover if Trace Group Hold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:T57

Trace Group Hold

Through its subsidiaries, engages in the infrastructure construction, rehabilitation, maintenance, design, and related activities in Bulgaria and internationally.

Average dividend payer with slight risk.

Market Insights

Community Narratives