- Belgium

- /

- Electronic Equipment and Components

- /

- ENXTBR:PAY

What Do The Returns At Payton Planar Magnetics (EBR:PAY) Mean Going Forward?

There are a few key trends to look for if we want to identify the next multi-bagger. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Payton Planar Magnetics' (EBR:PAY) returns on capital, so let's have a look.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Payton Planar Magnetics:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = US$10m ÷ (US$67m - US$7.2m) (Based on the trailing twelve months to September 2020).

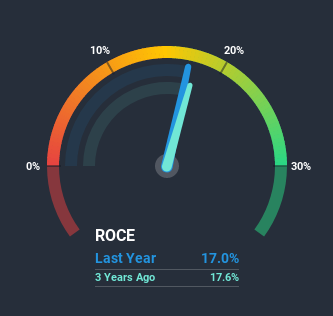

Thus, Payton Planar Magnetics has an ROCE of 17%. On its own, that's a standard return, however it's much better than the 10% generated by the Electronic industry.

View our latest analysis for Payton Planar Magnetics

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Payton Planar Magnetics' past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Payton Planar Magnetics Tell Us?

Payton Planar Magnetics is displaying some positive trends. The data shows that returns on capital have increased substantially over the last five years to 17%. The amount of capital employed has increased too, by 66%. So we're very much inspired by what we're seeing at Payton Planar Magnetics thanks to its ability to profitably reinvest capital.

The Key Takeaway

All in all, it's terrific to see that Payton Planar Magnetics is reaping the rewards from prior investments and is growing its capital base. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

While Payton Planar Magnetics looks impressive, no company is worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether PAY is currently trading for a fair price.

While Payton Planar Magnetics isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading Payton Planar Magnetics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:PAY

Payton Planar Magnetics

Develops, manufactures, and markets planar and conventional transformers worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026