- Belgium

- /

- Electronic Equipment and Components

- /

- ENXTBR:BAR

Did Barco’s (ENXTBR:BAR) Expanded AV Partnerships Just Shift Its Wireless Meeting Room Growth Story?

Reviewed by Sasha Jovanovic

- Earlier this month, Barco announced the expansion of its strategic ClickShare partnerships with Sennheiser, Logitech, and Huddly, aiming to deliver integrated, high-performance meeting room solutions through certified room system bundles built around the new ClickShare Hub.

- This collaboration leverages advanced audio and video technologies to strengthen Barco's position in the wireless BYOD and meeting room systems market, facilitating broader adoption of its solutions in diverse meeting spaces.

- Now, we’ll examine how the deepened integration with key audio-video partners could influence Barco’s investment narrative and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Barco Investment Narrative Recap

To be a shareholder in Barco, you need to believe that its continued push into integrated meeting room solutions, especially through deep partnerships for the ClickShare platform, can drive sustainable growth and improve the quality and reliability of its earnings. The recent expansion of alliances with Sennheiser, Logitech, and Huddly could support this catalyst by extending the reach of ClickShare into new meeting environments, but it may not be material enough in the short term to offset regional sales declines and competitive pressures in wireless conferencing solutions.

Among Barco’s recent announcements, the launch of the ClickShare Hub stands out as most relevant, given it forms the core of the enhanced room system bundles with these audio-video partners. This new product targets the faster-growing segment of hybrid and modular meeting spaces, potentially aiding in the company’s efforts to rekindle growth in the enterprise division and increase adoption amid changing workplace needs.

However, it's important to keep in mind that while collaboration could drive adoption, investors should also be aware of ongoing regional revenue challenges and what that means for...

Read the full narrative on Barco (it's free!)

Barco's narrative projects €1.1 billion revenue and €99.4 million earnings by 2028. This requires 4.2% yearly revenue growth and a €22.1 million earnings increase from €77.3 million today.

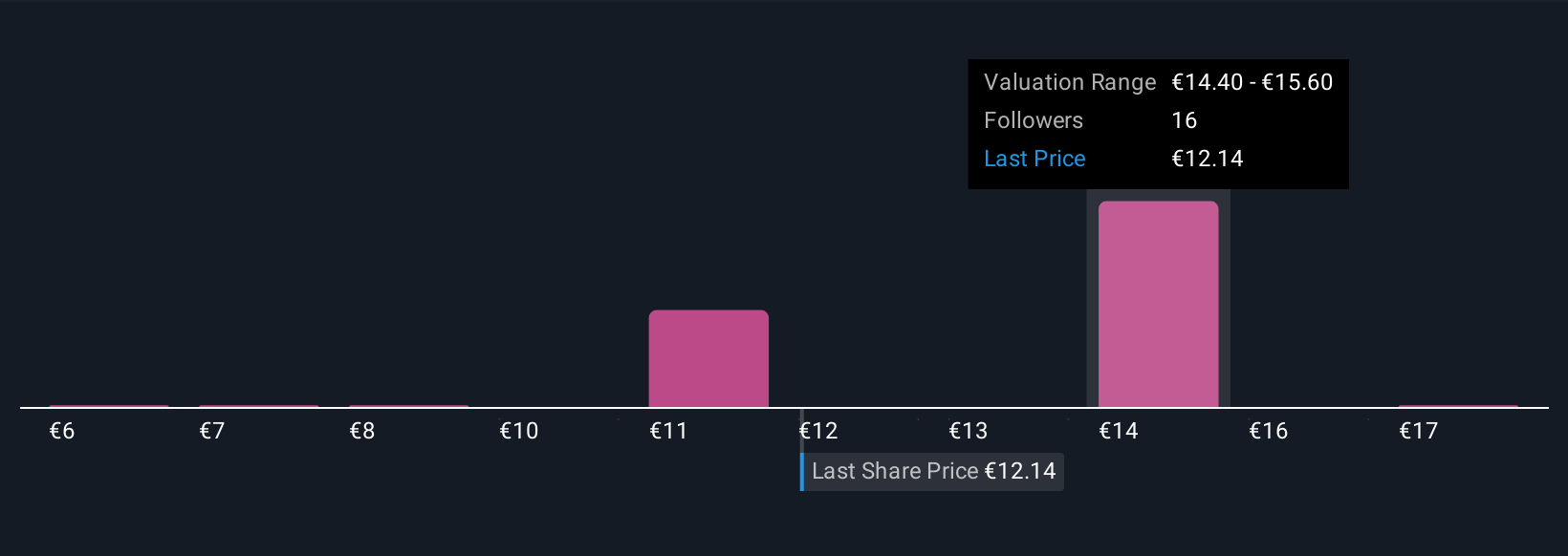

Uncover how Barco's forecasts yield a €14.70 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Seven community members on Simply Wall St have shared fair value estimates for Barco, ranging from €6.01 to €18 per share. With the company targeting higher-margin product introductions, you can explore how different outlooks reflect expectations for Barco’s earnings quality and resilience.

Explore 7 other fair value estimates on Barco - why the stock might be worth less than half the current price!

Build Your Own Barco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barco research is our analysis highlighting 6 key rewards that could impact your investment decision.

- Our free Barco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barco's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:BAR

Barco

Develops visualization solutions, and collaboration and networking technologies for the entertainment, enterprise, and healthcare markets in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives