As global markets navigate mixed performances and economic uncertainties, investors are increasingly seeking stability in their portfolios. Dividend stocks, known for their potential to provide consistent income even during volatile market conditions, can be an attractive option for those looking to balance risk and reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

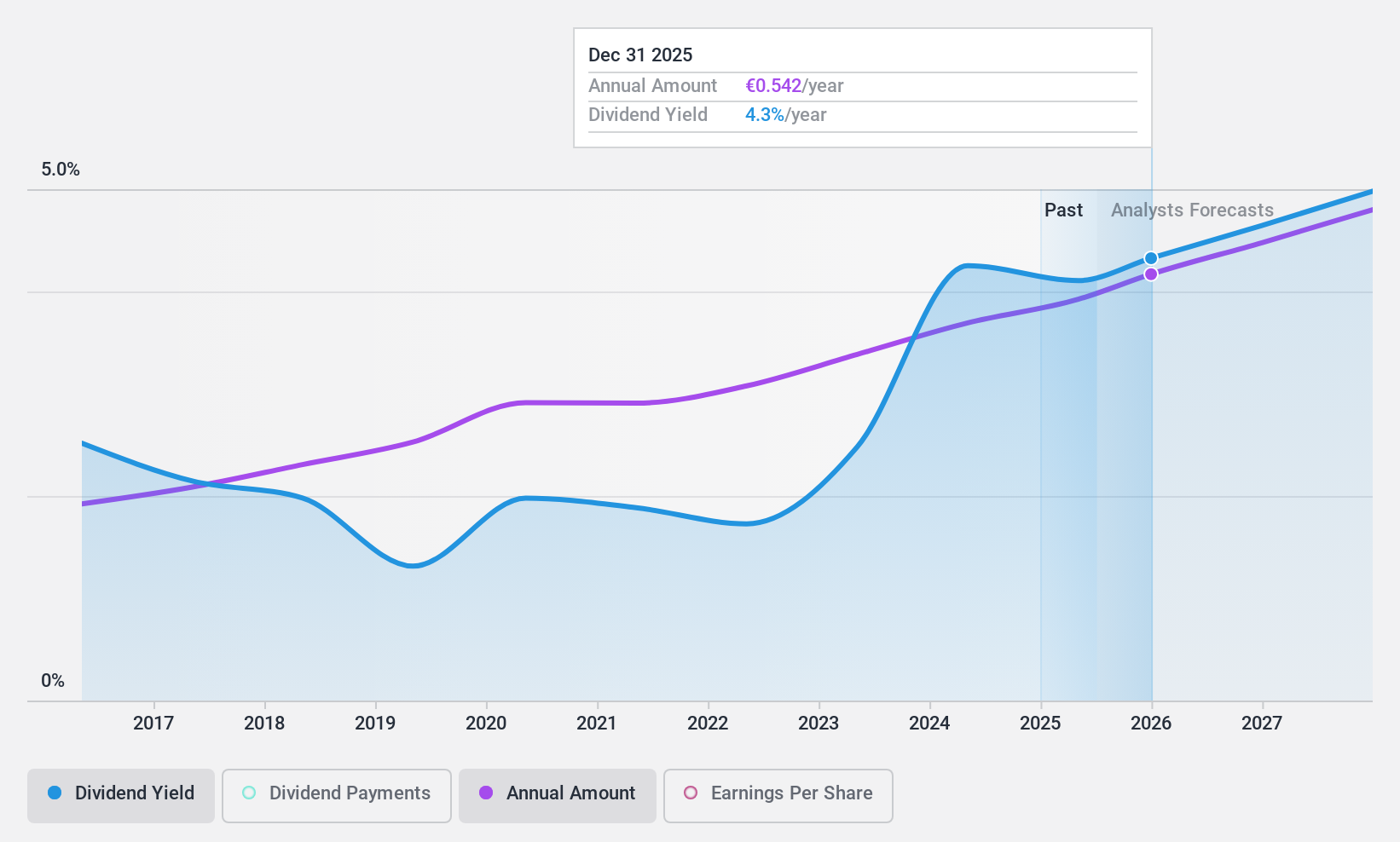

Barco (ENXTBR:BAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Barco NV, along with its subsidiaries, develops visualization solutions for the entertainment, enterprise, and healthcare markets across the Americas, Europe, Middle East, Africa, and the Asia-Pacific regions; it has a market cap of €915.93 million.

Operations: Barco NV generates revenue from three primary segments: Enterprise (€271.43 million), Healthcare (€269.53 million), and Entertainment (€422.79 million).

Dividend Yield: 4.6%

Barco's dividend payments have been reliable and stable over the past decade, with a payout ratio of 77.8% covered by earnings and a cash payout ratio of 54%, ensuring sustainability. Although its dividend yield of 4.64% is lower than the Belgian market's top tier, it remains attractive due to consistent growth. Trading at good value, Barco is currently priced below fair value estimates, suggesting potential for capital appreciation alongside dividend income.

- Click to explore a detailed breakdown of our findings in Barco's dividend report.

- According our valuation report, there's an indication that Barco's share price might be on the cheaper side.

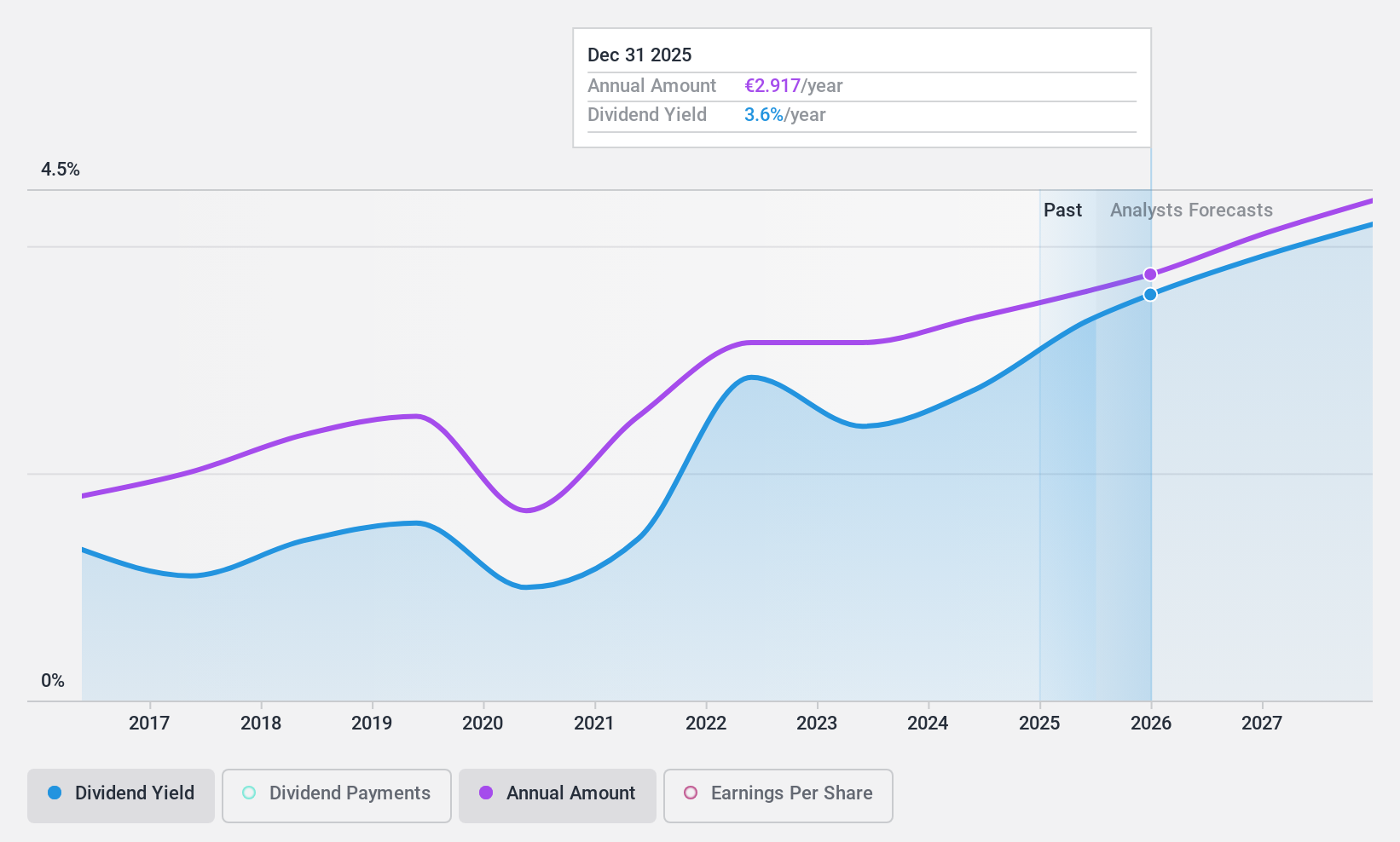

SEB (ENXTPA:SK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SEB SA designs, manufactures, and markets small domestic equipment worldwide, with a market cap of €4.73 billion.

Operations: SEB SA generates its revenue from the Professional Business segment (€1.02 billion), Consumer Business in Asia (€4.15 billion), Consumer Business in EMEA (€3.76 billion), and Consumer Business in the Americas (€1.13 billion).

Dividend Yield: 3%

SEB's dividend payments have been volatile over the past decade, with a low payout ratio of 34.9% covered by earnings and 28.7% by cash flows, indicating sustainability despite unpredictability. The stock trades at a significant discount to its estimated fair value and is considered good value compared to peers. However, its dividend yield of 3.01% lags behind the French market's top tier, while high debt levels may pose financial risks.

- Navigate through the intricacies of SEB with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that SEB is trading behind its estimated value.

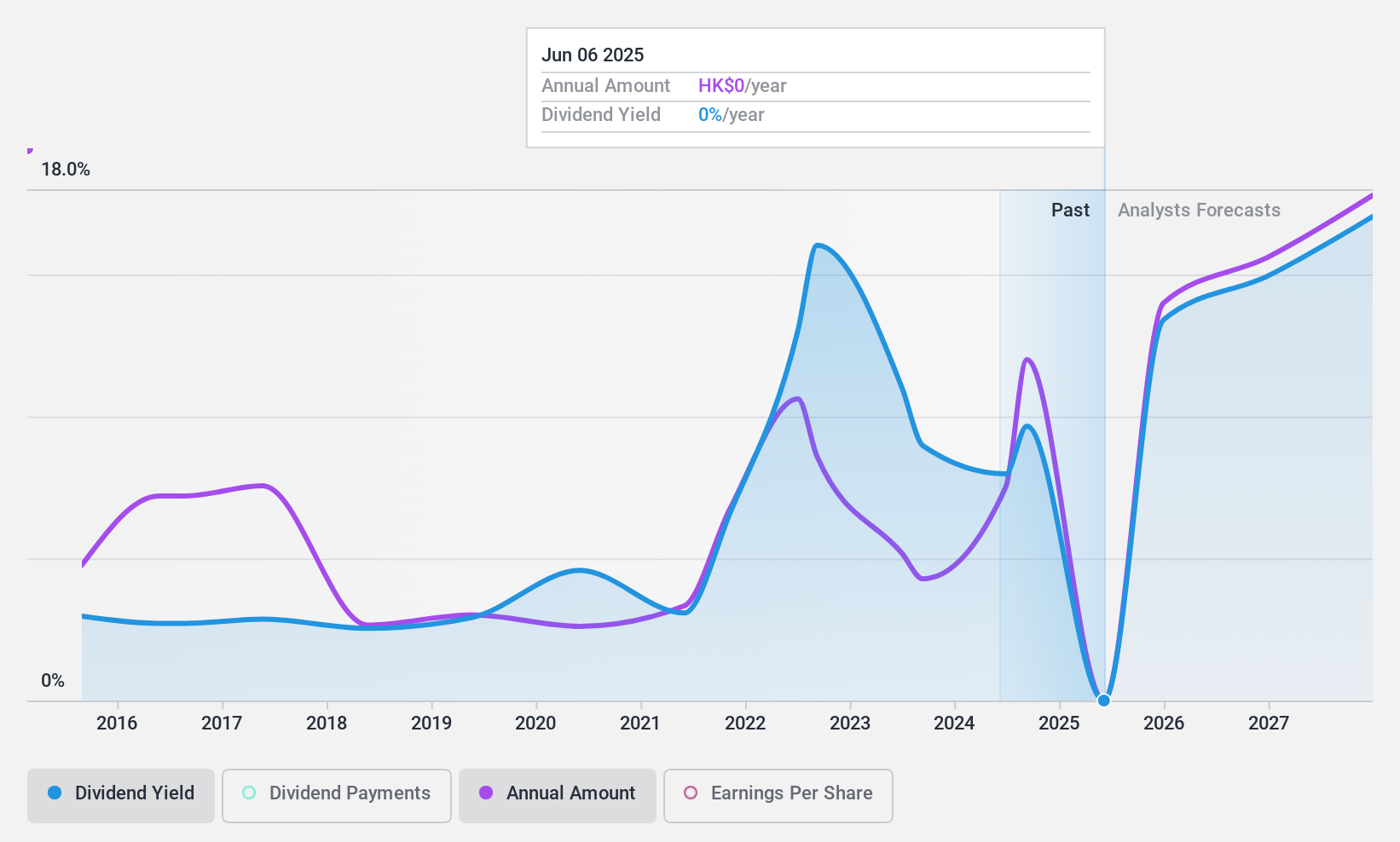

Best Pacific International Holdings (SEHK:2111)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Best Pacific International Holdings Limited, with a market cap of HK$3.13 billion, operates in the manufacturing, trading, and sale of elastic fabric, elastic webbing, and lace through its subsidiaries.

Operations: Best Pacific International Holdings Limited generates revenue from its segments, with HK$915.53 million from the manufacturing and trading of elastic webbing, and HK$3.76 billion from the manufacturing and trading of elastic fabric and lace.

Dividend Yield: 8.9%

Best Pacific International Holdings offers a compelling dividend yield of 8.86%, placing it in the top 25% of Hong Kong's dividend payers, supported by a payout ratio of 52.9% and a cash payout ratio of 45.3%. The stock trades at a significant discount to its estimated fair value, suggesting potential value for investors. However, its dividend history is marked by volatility and unreliability over the past decade, despite recent earnings growth strengthening coverage prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Best Pacific International Holdings.

- The analysis detailed in our Best Pacific International Holdings valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Click here to access our complete index of 1983 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Pacific International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2111

Best Pacific International Holdings

Manufactures, trades in, and sells elastic fabric, elastic webbing, and lace.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives